By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

Reverse Mortgage & Probate: What Happens Legally?

When considering reverse mortgages and probate, many seniors are unsure about how the process works after they pass away. A common question is whether a reverse mortgage goes through probate — the legal process of distributing a person’s estate after death.

If you’re wondering how your reverse mortgage might affect your estate and heirs, this guide is for you. You may also want to review the key reverse mortgage pros and cons to better understand how this option fits into your overall retirement plan.

In this detailed guide, we’ll break down the legal implications of reverse mortgages in relation to probate. We’ll address common concerns such as whether the loan balance goes through probate, how heirs are impacted, and what steps are needed to manage the reverse mortgage after death.

By the end of this post, you’ll have a clear understanding of how reverse mortgages interact with probate—and how to plan ahead.

Why Understanding Probate Matters

Many homeowners worry about what happens to their property and finances after they’re gone — especially if they have a reverse mortgage.

Probate is often misunderstood, and that confusion can create stress for both homeowners and their families.

The good news is that reverse mortgages are designed to make things simpler, not harder, when it comes to settling your estate.

Understanding how the loan interacts with probate can help you plan ahead, protect your heirs, and ensure your wishes are carried out smoothly.

By learning the basics now, you can prevent future complications and give your loved ones the peace of mind they deserve.

What Is a Reverse Mortgage?

Before diving into the specifics of how reverse mortgages relate to probate, let’s quickly review what a reverse mortgage is. Learn more about how reverse mortgages work to understand the basics before moving forward.

A reverse mortgage is a loan that allows homeowners, typically aged 62 and older, to convert part of their home’s equity into cash or a line of credit. Unlike traditional mortgages, there are no monthly payments to make. Instead, the loan balance grows over time and is repaid when the homeowner sells the home, moves out,

or passes away. See what you could qualify for with a reverse mortgage.

The Home Equity Conversion Mortgage (HECM) is the most common type of reverse mortgage. It is insured by the government and regulated by the Federal Housing Administration (FHA). There are also jumbo reverse mortgages for those with high-value properties that exceed FHA limits.

Reverse mortgages can be a useful tool for seniors who need additional income in retirement or want to access their home equity without selling their home. However, it’s important to understand the legal process that will follow once the homeowner passes away, and the role probate plays in that process.

Does a Reverse Mortgage Go Through Probate?

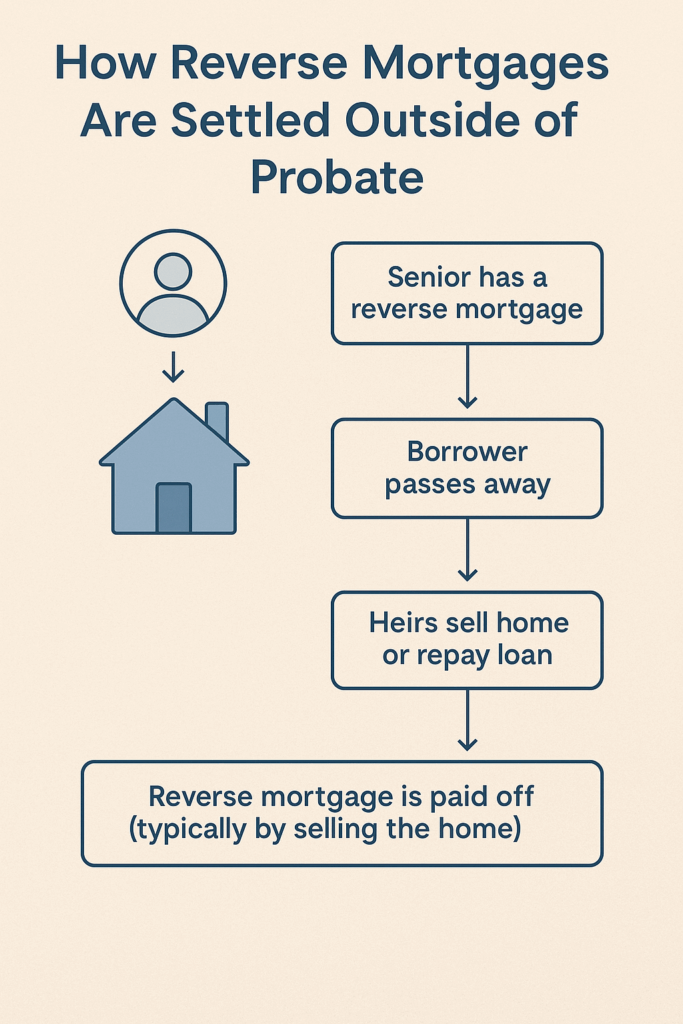

In most cases, a reverse mortgage does not go through probate. Probate is the legal process through which the court validates a will, settles debts, and distributes the remaining assets to heirs after someone passes away. With a reverse mortgage, the situation is a little different from other types of loans.

Reverse mortgages are secured loans, meaning that the home itself is used as collateral.

When the homeowner passes away, the loan must be repaid. However, since it is a secured loan, the property itself is the asset that satisfies the debt.

Here’s why a reverse mortgage typically doesn’t go through probate:

- The Reverse Mortgage Is a Loan, not a Debt to the Estate

A reverse mortgage is not a traditional debt like credit card debt or personal loans. Instead, it is a loan that is secured by the home. When the homeowner passes away, the reverse mortgage lender will typically start the process of recovering the loan amount by selling the home. The proceeds from the sale of the home go toward paying off the reverse mortgage loan balance, and any remaining funds, can be passed to the heirs. In essence, the home serves as collateral for the loan. This means that when the homeowner passes, the reverse mortgage lender will look to the home to satisfy the loan balance, not the decedent’s estate. Therefore, the reverse mortgage doesn’t typically go through the probate process. - The Lender Can Reclaim the Home

If the homeowner passes away, the reverse mortgage lender will typically begin the process of reclaiming the loan by selling the home. This is done outside of probate, as the sale of the property is a direct way to settle the debt. However, the sale of the home might be included in the probate proceedings if the proceeds are used to pay off any additional debts or be distributed among the heirs.

Does the Home Need to Go Through Probate?

Although reverse mortgages do not typically go through probate, the home itself might still be part of the probate process, especially if there are other assets in the estate that need to be distributed. The estate will handle the distribution of any remaining assets after the reverse mortgage is repaid. This includes any other property or funds that the deceased homeowner owned. The probate court will typically oversee the sale of the home and

ensure that the reverse mortgage loan is paid off before any remaining equity is passed to the heirs.

How Heirs Can Avoid Delays in the Process?

If heirs are named in the will and are willing to sell or pay off the reverse mortgage, the probate process can be straightforward. However, if there are disputes among heirs, delays can occur. To avoid any confusion or delays, it is essential for homeowners with reverse mortgages to discuss their estate plans with a trusted advisor and make their wishes clear.

When Probate Might Still Apply

While the reverse mortgage itself usually bypasses probate, the home may still be included in the process if there are other assets or legal considerations.

For example:

- If there are disputes among heirs about whether to sell or keep the property.

- If your estate includes multiple properties or shared assets that must be divided.

- If state law requires probate for certain types of ownership (like tenants in common).

The key takeaway: a reverse mortgage can reduce complications, but it doesn’t automatically eliminate the need for probate.

It’s always wise to review your estate plan with an attorney or advisor who understands local probate laws.

Why Reverse Mortgages Usually Bypass Probate

Reverse mortgages are unique because they’re tied directly to your home — not your personal estate.

That means when the time comes to repay the loan, it’s the property itself that satisfies the balance, not your other assets or accounts.

This setup helps families avoid lengthy court procedures that can delay access to funds or property.

Since the home sale typically settles the debt, the reverse mortgage process usually runs separately from the rest of the estate.

In most cases, this means:

- Your heirs don’t have to handle the loan through the probate court.

- The lender takes care of repayment directly through the home’s sale.

- Any leftover equity still goes to your beneficiaries once the loan is paid.

In short, reverse mortgages simplify the transition — reducing red tape when your family needs clarity most.

How Does the Reverse Mortgage Affect Heirs?

While a reverse mortgage typically does not go through probate, it will affect the heirs of the

deceased homeowner in the following ways:

- The Home Will Be Sold to Repay the Loan Upon the Death of the Homeowner, the reverse mortgage lender will typically begin the process of selling the home. The sale of the home is used to pay off the reverse mortgage loan balance. If there is any remaining equity in the home after the loan is paid, that equity will be passed to the heirs. However, if the home’s sale price is lower than the reverse mortgage balance, the lender cannot pursue the heirs for the difference, because reverse mortgages are non-recourse loans.

- Heirs Can Choose to Keep or Sell the Home If the heirs wish to keep the home, they have several options like paying off the reverse mortgage, if the home is worth more than the reverse mortgage loan, the heirs can pay off the loan balance and retain the property. If the heirs qualify, they can refinance the reverse mortgage with a traditional mortgage or other financing options. If the heirs don’t want the home, they can sell it and use the proceeds to pay off the loan. Any remaining profits from the sale will be distributed to the heirs.

Are You Eligible for a Reverse Mortgage?

(Find out in 60 seconds)

Steps Heirs Can Take to Simplify the Process

If you’re planning your estate — or if you’re an heir handling a loved one’s reverse mortgage — a few proactive steps can make the process easier:

- Keep documents organized. Store the loan agreement, appraisal, and contact information for the lender in one place.

- Communicate with the lender early. Notifying the lender as soon as possible can prevent delays and help manage deadlines.

- Request an appraisal quickly. This determines the home’s current market value and helps set expectations for repayment or sale.

- Decide as a family. Agree in advance whether to keep or sell the property. This avoids emotional decisions under pressure.

- Seek professional guidance. A real estate attorney or reverse mortgage specialist can walk heirs through each step.

Clear planning now can save your family months of uncertainty later.

What to Do When a Reverse Mortgage Holder Dies

After a homeowner passes away, heirs should follow these steps:

- Notify the reverse mortgage lender: The lender must be informed of the homeowner’s death, and the loan balance will begin to accrue interest.

- Get an appraisal: The lender will schedule an appraisal to determine the home’s current market value.

- Sell or refinance the home: The heirs must decide whether they want to keep the home or sell it. If they sell the home, the reverse mortgage loan balance will be paid off from the proceeds.

- Distribute any remaining equity: If the home is sold for more than the reverse mortgage balance, the excess funds will be distributed to the heirs.

Get more details from the Consumer Protection Financial Bureau.

The Role of the Reverse Mortgage Line of Credit in Probate

A reverse mortgage line of credit functions similarly to a standard reverse mortgage, with one key difference: it allows homeowners to borrow funds as needed rather than receiving a lump sum or monthly payments. Explore how a reverse mortgage line of credit works to understand its advantages.

However, just like other reverse mortgages, the line of credit must be repaid when the homeowner passes away.

If heirs don’t wish to keep the home, they can sell it to pay off the balance. If the home’s value exceeds the loan balance, the remaining equity can be passed to the heirs. If the home’s value is lower, the lender typically forgives the difference, and the heirs are not responsible for paying the remaining debt.

What Happens to an Unused Line of Credit

If you have a reverse mortgage line of credit and pass away before using all of it, the unused portion simply expires — it does not pass to heirs as cash.

However, any funds that were already withdrawn become part of your estate and can be handled during probate if not spent or transferred.

It’s important to understand that while the line of credit ends, your home’s value may still cover the entire balance — and any remaining equity goes to your heirs.

This ensures that your family receives whatever value remains, while the loan itself is settled cleanly through the sale or repayment of the property.

Things to Remember

- Reverse mortgages typically do not go through probate, as the loan is secured by the home.

- The loan is repaid through the sale of the home when the homeowner passes away.

- Heirs can either sell the home, refinance, or pay off the reverse mortgage to keep the property.

- Reverse mortgages are non-recourse loans, meaning heirs are not personally liable for the loan balance beyond the home’s value.

- The reverse mortgage line of credit works the same way but provides flexibility in how funds are used before the homeowner’s death.

Planning Ahead: How to Keep Probate Simple

The best way to prevent complications is to plan early.

Whether you already have a reverse mortgage or are considering one, take time to:

- Review your will and estate documents.

- Add clear instructions about the home and loan.

- Designate a point of contact for your lender.

- Discuss your plans with your heirs so everyone understands what to expect.

These small steps make a big difference. They help ensure your reverse mortgage supports your retirement goals and leaves a clear path for your family later.

Talk to a Reverse Mortgage Specialist

Probate and reverse mortgages can sound complicated — but they don’t have to be.

At South River Mortgage, we help families understand how the process works from start to finish, so you can feel confident your home and loved ones are protected.

Call (844) 230-6679 to speak with a licensed specialist or check your free reverse mortgage eligibility in under a minute.

FAQ: Reverse Mortgages and Probate

Does a reverse mortgage automatically go through probate?

No. Because it’s secured by your home, the reverse mortgage balance is usually repaid through the home’s sale — not the probate court.

Can my heirs keep the home after I pass away?

Yes. They can pay off or refinance the loan to keep the property.

What if the home is worth less than the loan balance?

Your heirs are protected. The lender can only recover the home’s value — they’re never personally responsible for the difference.

Do I need to change my will if I get a reverse mortgage?

It’s a good idea. Updating your estate plan ensures your wishes are clear and avoids confusion later.

Can the process be delayed if my heirs disagree?

Yes, disputes among heirs can slow things down. That’s why open communication and clear planning are essential.