Utah Reverse Mortgage Lenders

Trusted Utah reverse mortgage lender. Unlock retirement cash with an FHA-insured HECM—no payments, no stress. A+ BBB rating.

Reverse Mortgage Product Options in Utah

| HomeForLife | HECM | |

| Traditional Reverse Mortgage (Reverse Mortgage 101) | Yes | Yes |

| Refinance Existing Reverse Mortgage with Another (HECM to HECM) | Yes | Yes |

| Purchase a Home with a Reverse Mortgage (HECM for Purchase) | Yes | Yes |

| Minimum Age for Eligibility in UT | 55 | 62 |

| Get Your Quote → | Get Your Quote → |

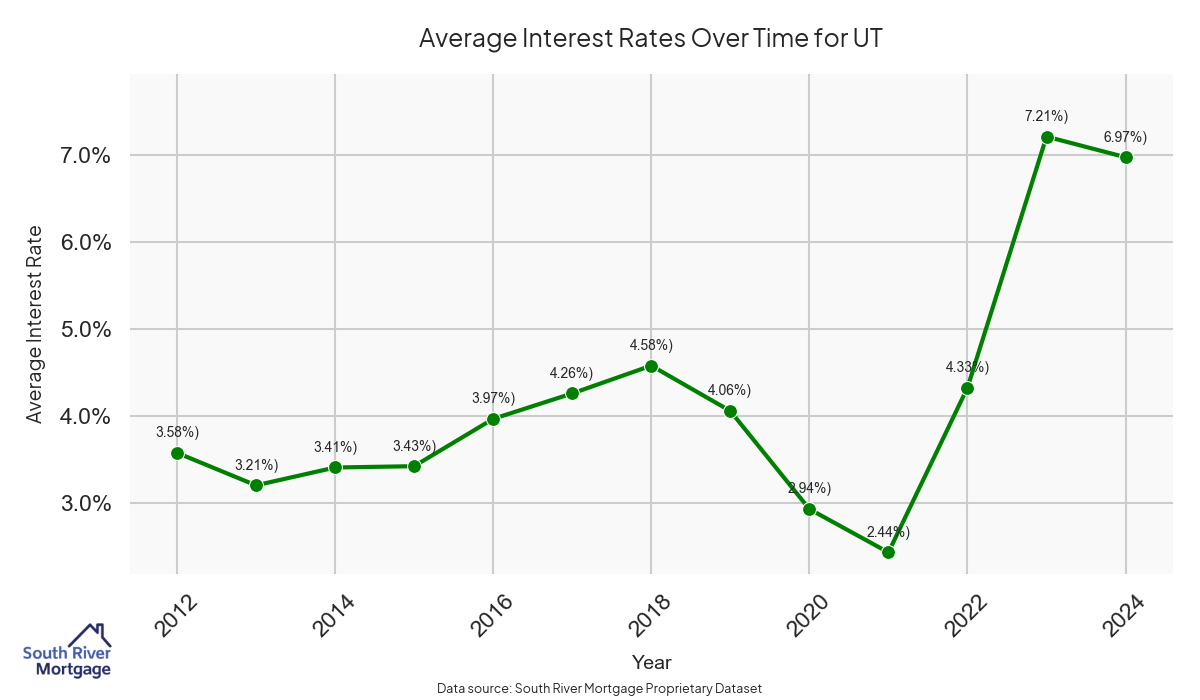

Reverse Mortgage Interest Rates in Utah

As of today, the 10-year CMT index is trading at 4.00%. Reverse mortgage interest rates adjust weekly on Tuesdays, so the next adjustment date will be Tuesday, November 4, 2025. (Updated 30 October 2025)

The projected index for next week is 4.00%, compared to this week’s index, which is 4.00%. This means that rates are projected to be between 5.75% and 6.50%.

Click to learn more about Reverse Mortgage Interest Rates (& how they affect you) →

Local Reverse Mortgage Lenders in Utah

Although South River Mortgage originates loans all across the country, we do maintain a local presence in Utah. We have a resident agent location at 2005 East 2700 South, Suite 200, Salt Lake City, UT 84109. Get Your Quote →

HUD also maintains a list of local lenders. Get Your Quote →

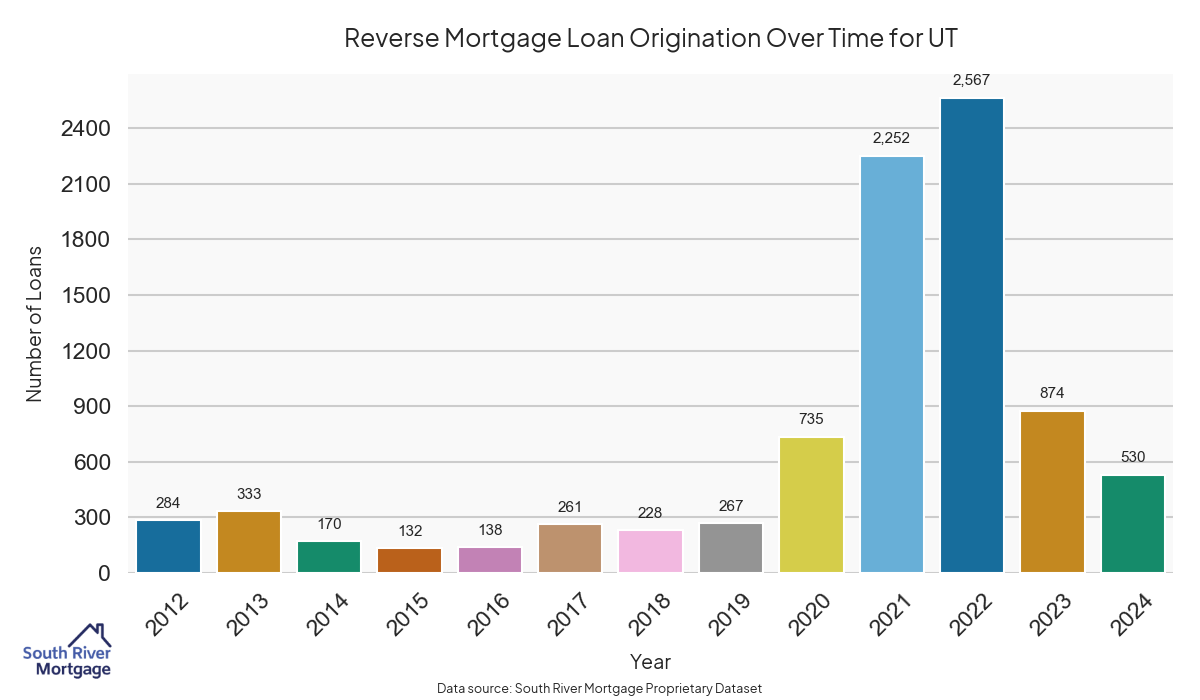

Reverse Mortgage Loan Origination Statistics in Utah

We have pulled together a number of useful reverse mortgage loan statistics for UT. These loan origination statistics are put together below as a courtesy, and as such, we cannot make any guarantees about the accuracy of the information.

Note that this data was sourced from a proprietary data set, so it includes loans outside of the FHA HECM loans listed on the HECM Portfolio Snapshot.

Reverse Mortgages in Utah

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

.

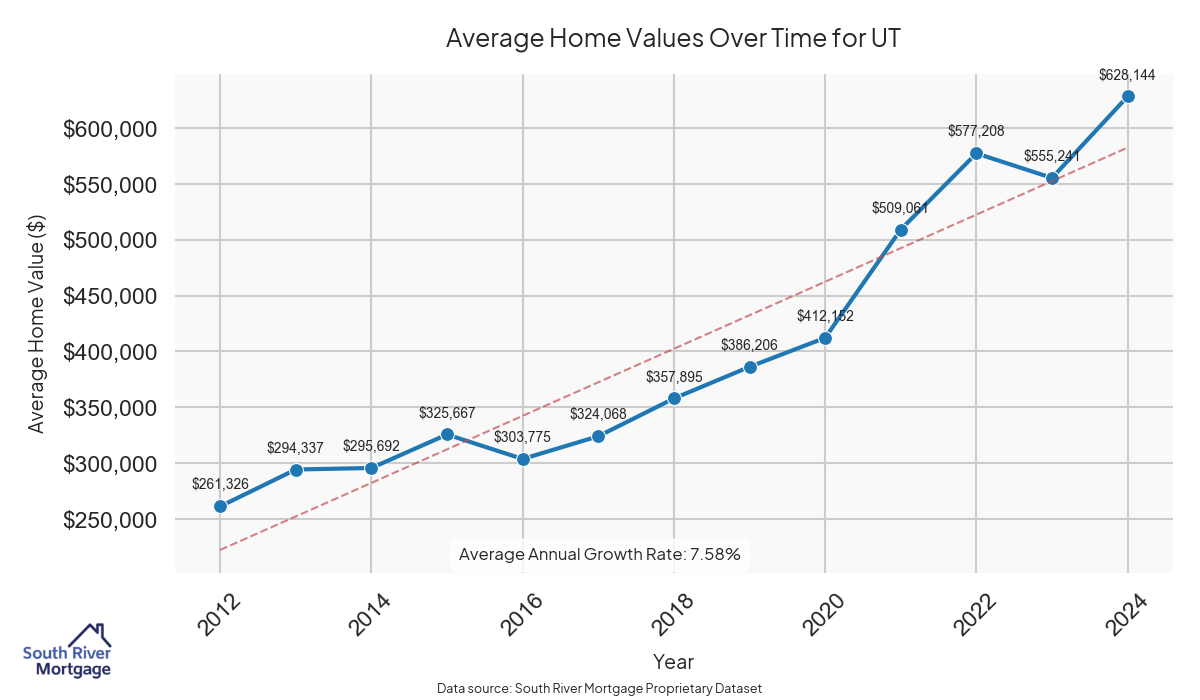

Average Reverse Mortgage Home Values in Utah

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

Reverse Mortgage Interest Rates in Utah

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

State Regulator & Licensing in Utah

Make sure you are working with a licensed mortgage lender in Utah. South River Mortgage maintains approval with Utah and holds the Mortgage Entity License #12662523.

County-Specific Loan Information in Utah

Utah has 17, and each county has its own specifics. We have compiled county-by-county loan statistics and information, whether you are looking for a reverse mortgage or just curious about loan origination activity. Kindly note that this information is provided on a best-efforts basis – and while we do as much quality control work as possible – we make no guarantees to the accuracy of loan statistical information provided

Choose any county to learn more about reverse mortgages in that area: