Texas Reverse Mortgage Lenders

Trusted Texas reverse mortgage lender. Unlock retirement cash with an FHA-insured HECM—no payments, no stress. A+ BBB rating.

Reverse Mortgage Product Options in Texas

| HomeForLife | HECM | |

| Traditional Reverse Mortgage (Reverse Mortgage 101) | Yes | Yes |

| Refinance Existing Reverse Mortgage with Another (HECM to HECM) | Yes | Yes |

| Purchase a Home with a Reverse Mortgage (HECM for Purchase) | Yes | Yes |

| Minimum Age for Eligibility in TX | 62 | 62 |

| Get Your Quote → | Get Your Quote → |

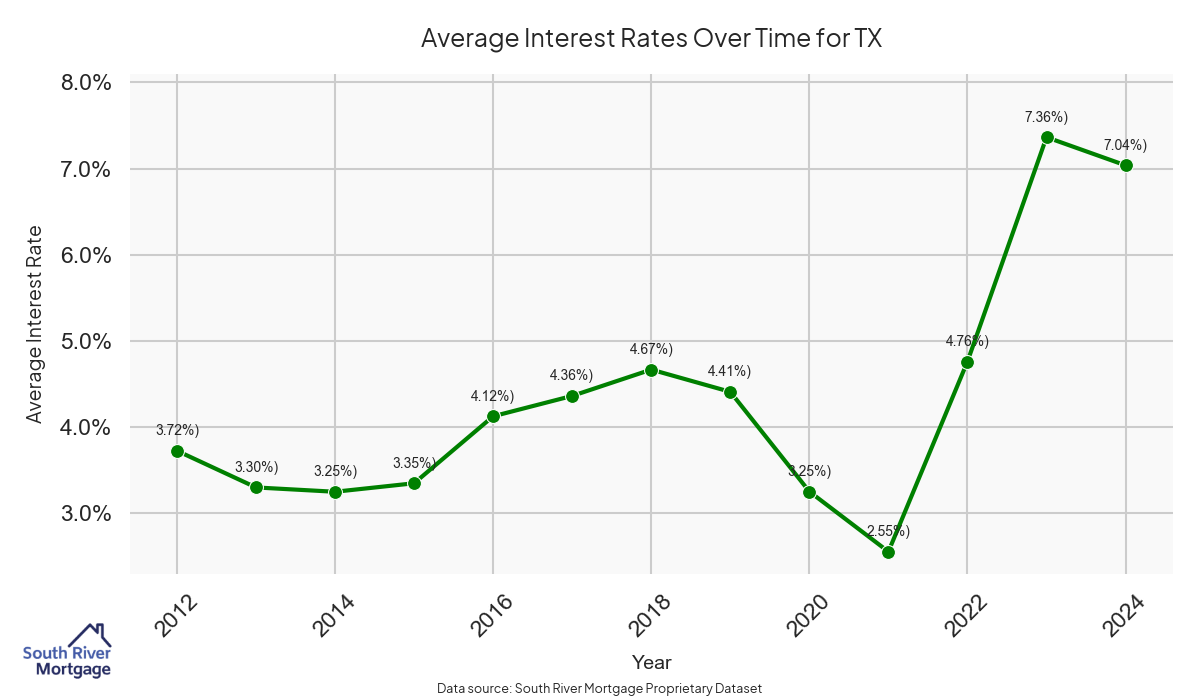

Reverse Mortgage Interest Rates in Texas

As of today, the 10-year CMT index is trading at 4.13%. Reverse mortgage interest rates adjust weekly on Tuesdays, so the next adjustment date will be Tuesday, January 13, 2026. (Updated 7 January 2026)

The projected index for next week is 4.13%, compared to this week’s index, which is 4.13%. This means that rates are projected to be between 5.88% and 6.63%.

Click to learn more about Reverse Mortgage Interest Rates (& how they affect you) →

Local Reverse Mortgage Lenders in Texas

Although South River Mortgage originates loans all across the country, we do maintain a local presence in Texas. We have a resident agent location at 805 COUNTRY CLUB DR, HEATH, TX 75032. Get Your Quote →

HUD also maintains a list of local lenders. Get Your Quote →

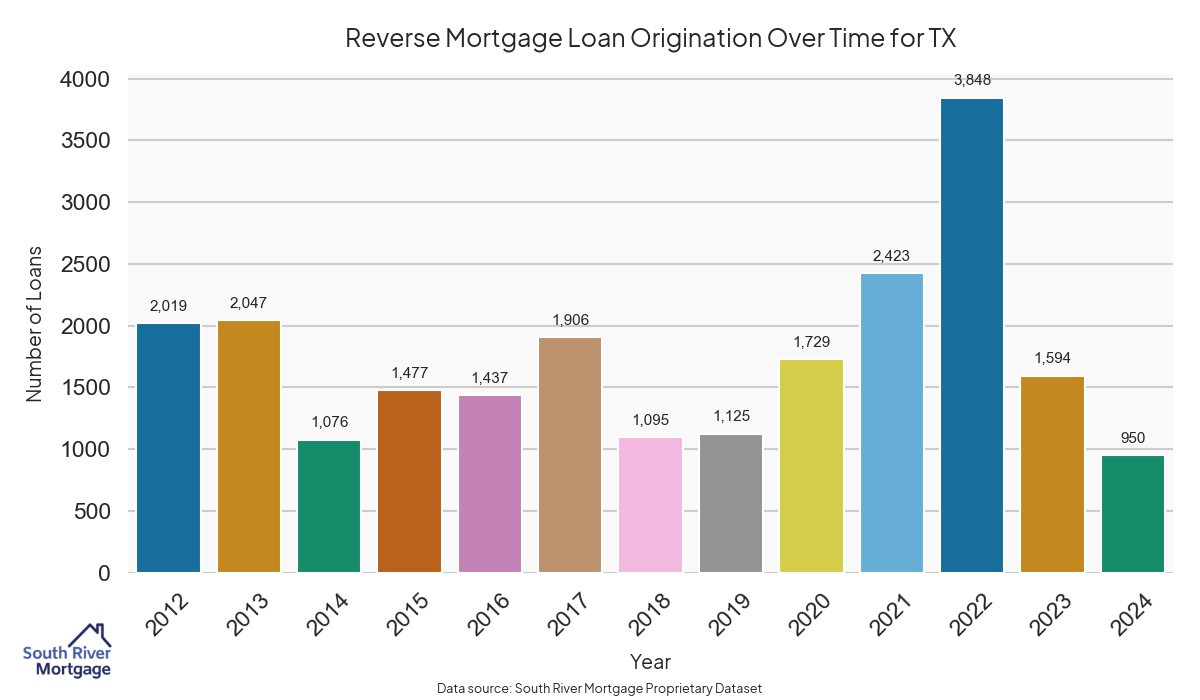

Reverse Mortgage Loan Origination Statistics in Texas

We have pulled together a number of useful reverse mortgage loan statistics for TX. These loan origination statistics are put together below as a courtesy, and as such, we cannot make any guarantees about the accuracy of the information.

Note that this data was sourced from a proprietary data set, so it includes loans outside of the FHA HECM loans listed on the HECM Portfolio Snapshot.

Reverse Mortgages in Texas

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

.

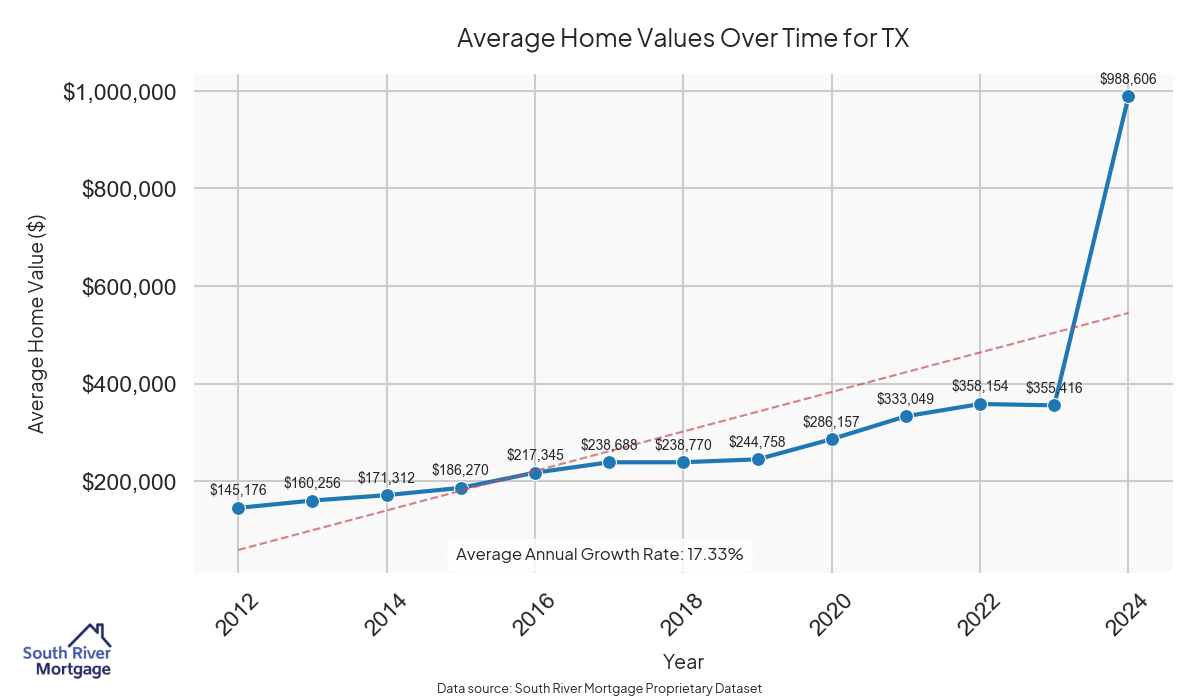

Average Reverse Mortgage Home Values in Texas

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

Reverse Mortgage Interest Rates in Texas

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

State Regulator & Licensing in Texas

Make sure you are working with a licensed mortgage lender in Texas. South River Mortgage maintains approval with Texas and holds the Department of Savings and Mortgage Lending Mortgage Company License #1854524.

County-Specific Loan Information in Texas

Texas has 132, and each county has its own specifics. We have compiled county-by-county loan statistics and information, whether you are looking for a reverse mortgage or just curious about loan origination activity. Kindly note that this information is provided on a best-efforts basis – and while we do as much quality control work as possible – we make no guarantees to the accuracy of loan statistical information provided

Choose any county to learn more about reverse mortgages in that area:

- Anderson County

- Angelina County

- Archer County

- Atascosa County

- Austin County

- Bandera County

- Bastrop County

- Bee County

- Bell County

- Bexar County

- Blanco County

- Bosque County

- Bowie County

- Brazoria County

- Brazos County

- Brown County

- Burleson County

- Burnet County

- Caldwell County

- Cameron County

- Camp County

- Cass County

- Castro County

- Chambers County

- Cherokee County

- Coleman County

- Collin County

- Colorado County

- Comal County

- Cooke County

- Coryell County

- Dallas County

- Delta County

- Denton County

- DeWitt County

- Duval County

- Eastland County

- Ector County

- Ellis County

- El Paso County

- Erath County

- Falls County

- Fannin County

- Fayette County

- Fort Bend County

- Freestone County

- Galveston County

- Gillespie County

- Gonzales County

- Gray County

- Grayson County

- Gregg County

- Grimes County

- Guadalupe County

- Hamilton County

- Hardin County

- Harris County

- Harrison County

- Hays County

- Henderson County

- Hidalgo County

- Hill County

- Hood County

- Hopkins County

- Houston County

- Howard County

- Hunt County

- Jefferson County

- Jim Wells County

- Johnson County

- Kaufman County

- Kendall County

- Kerr County

- Kleberg County

- Lamar County

- Lampasas County

- Lavaca County

- Lee County

- Leon County

- Liberty County

- Llano County

- Lubbock County

- McLennan County

- Madison County

- Matagorda County

- Medina County

- Midland County

- Milam County

- Montague County

- Montgomery County

- Navarro County

- Nueces County

- Orange County

- Palo Pinto County

- Parker County

- Polk County

- Potter County

- Presidio County

- Rains County

- Randall County

- Real County

- Red River County

- Refugio County

- Robertson County

- Rockwall County

- Runnels County

- San Jacinto County

- San Patricio County

- Scurry County

- Smith County

- Tarrant County

- Taylor County

- Titus County

- Tom Green County

- Travis County

- Tyler County

- Upshur County

- Uvalde County

- Val Verde County

- Van Zandt County

- Victoria County

- Walker County

- Waller County

- Washington County

- Webb County

- Wharton County

- Wichita County

- Williamson County

- Wilson County

- Wise County

- Wood County

- Young County