Reverse Mortgage Lenders in Crawford County, Pennsylvania – 2025

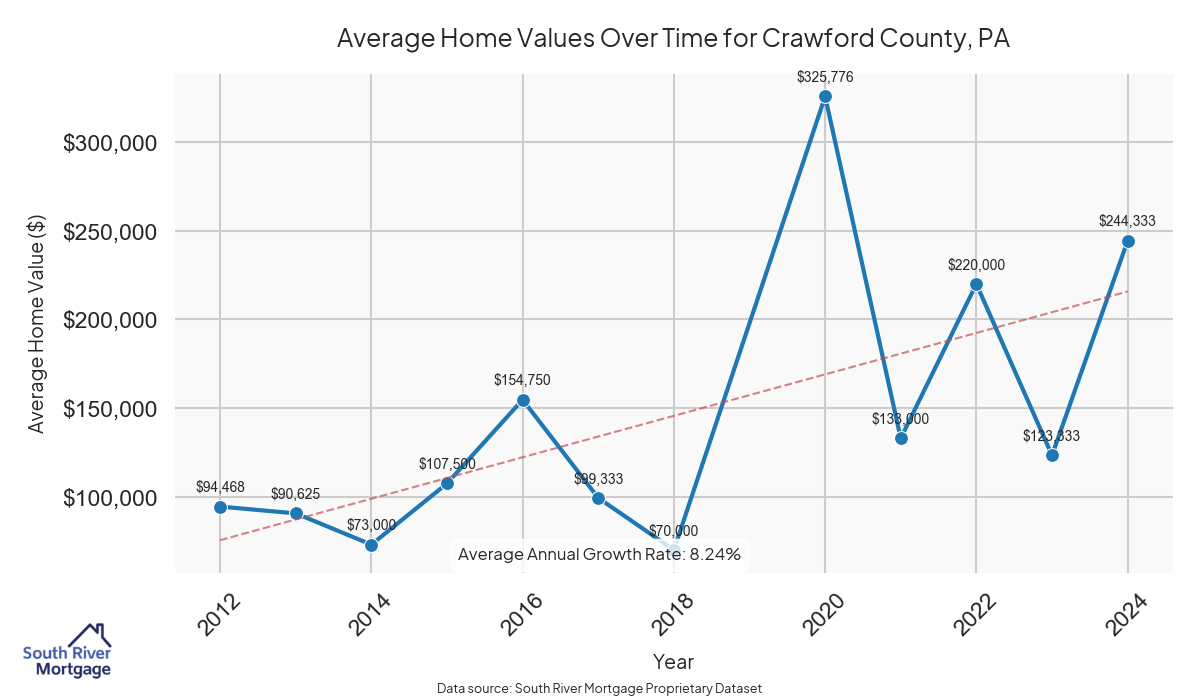

In 2024, there were 39 active reverse mortgage loans in Crawford County, Pennsylvania. The average home value in Crawford County is $144,765.92.

Click here to get a reverse Mortgage Quote in Crawford County, Pennsylvania

To avoid scams, make sure you are working with a licensed lender in Pennsylvania. South River Mortgage is a fully licensed lender in Pennsylvania. The PA state regulator requires mortgage lenders to be explicitly approved to make loans and hold a license. South River Mortgage proudly holds the Mortgage Lender License in PA, and our state license identifier is 94894. We also maintain active approval with HUD/FHA.

Reverse Mortgage Loans in Crawford County

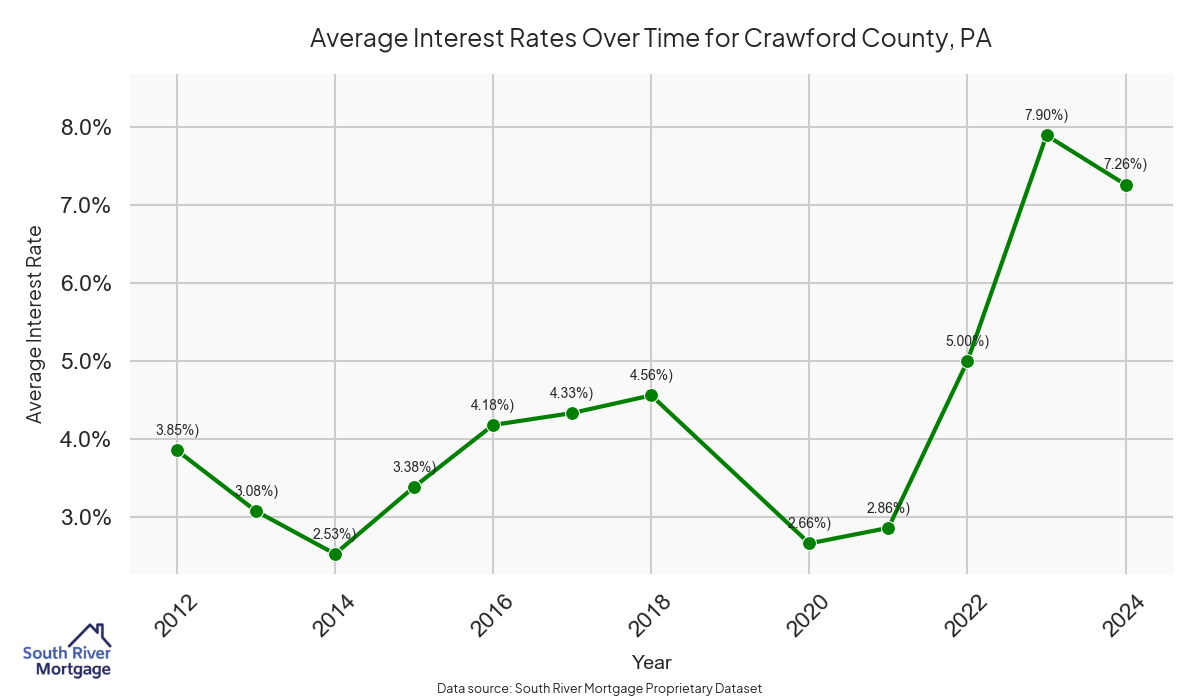

Crawford County, located in Pennsylvania, is home to a population of approximately 86,826 residents. The area boasts a vibrant community known for its picturesque landscapes, outdoor recreational activities, and rich history. Crawford County is famous for its numerous lakes and natural beauty, making it a popular destination for outdoor enthusiasts and nature lovers. With an average home value of $144,765.92, Crawford County offers affordable housing options for residents. The average property tax in the county is $2017.67, and the average interest rate currently stands at 4.06%. For seniors looking to tap into their home equity, Crawford County’s favorable property values and interest rates make it an attractive location for exploring options such as reverse mortgages. This financial tool can provide seniors with additional income during their retirement years while allowing them to continue living in the comfort of their own homes.

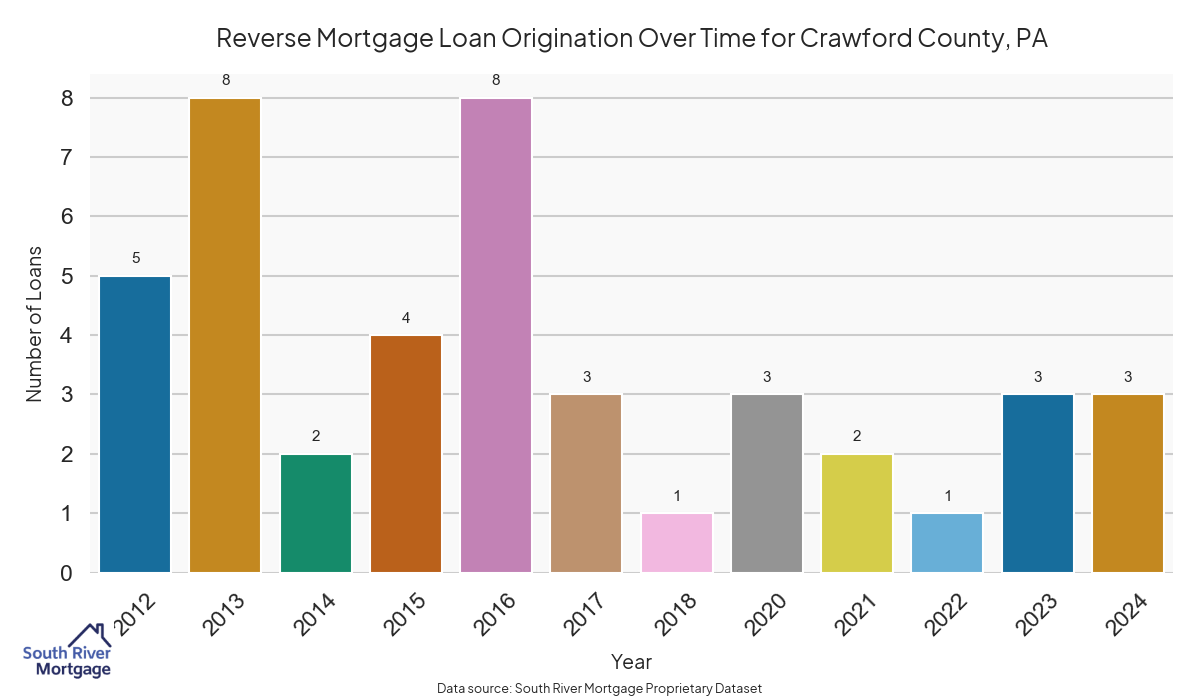

Reverse Mortgage Loan Origination in Crawford County

Reverse Mortgage Home Values in Crawford County

Reverse Mortgage Interest Rates Crawford County

There are approximately 39 active reverse mortgage loans in Crawford County. The average interest rate in Crawford County is 7.91% for reverse mortgages. The average maximum claim amount (the lesser of the appraisal or lending limit), among reverse mortgage borrowers, in Crawford County was $162,142.86 in 2024.

Click here to get a Reverse Mortgage Quote in Crawford County, Pennsylvania »

Note that our loan origination data will not exactly match FHA’s HECM portfolio snapshot. This discrepancy occurs because FHA’s reports are limited to loans endorsed by FHA (i.e. HECMs only). We use a series of custom data criteria that make it possible to identify all reverse mortgages: HECMs, proprietary, and even single-purpose reverse mortgages.

| Crawford County, PA Facts – As of 2025 | |

| Average property value (estimated) | $162,142.86 |

| Average property taxes | $2,017.67 |

| Average reverse mortgage interest rate | 7.91% |

| Area median income | $77,800.00 |

Data Source: FFIEC HMDA Data

Jumbo Reverse Mortgage in Crawford County, PA

With the average home value of $162,142.86, you may be wondering about the opportunities for jumbo loans.

| HomeForLife | HECM | |

| Traditional Reverse Mortgage | Yes | Yes |

| Refinance Existing Reverse Mortgage with Another (HECM to HECM) | Yes | Yes |

| Purchase a Home with a Reverse Mortgage (HECM for Purchase) | Yes | Yes |

| Minimum Age for Eligibility in PA | 55 | 62 |

| Get Your Quote → | Get Your Quote → |

The FHA has increased the HECM lending limit to $1,209,750 for 2025. If your property is valued above the HECM lending limit, you may be eligible for additional proceeds through the HomeForLife jumbo reverse mortgage.

Reverse Mortgage Refinance (HECM to HECM) in Crawford County

It might make sense to refinance your reverse mortgage. There are many situations where refinancing could be very beneficial to you:

- You want to get more cash out because your home value has increased substantially

- You want to pay less in interest by obtaining a lower interest rate

- You want to add a loved one to the reverse mortgage

As a bonus, South River Mortgage can sometimes provide multiple benefits at once, depending on the situation. There have been cases where we can help secure a lower interest rate and additional cash. In some cases, we have been able to do all three benefits: lower rate, more cash, and adding a son or daughter onto the mortgage.

South River Mortgage can help you refinance your reverse mortgage. Get a quote today »

Reverse for Purchase (HECM for Purchase) in Crawford County

You can now purchase a home with a reverse mortgage in {county}, PA. The reverse for purchase lets homebuyers purchase the home and get a reverse mortgage in a single transaction. The requirements for a reverse for purchase are very similar to the traditional reverse mortgage program.

Purchasing a home with a reverse mortgage has many benefits:

- No monthly mortgage payment (although you’d still be responsible for property taxes and homeowner’s insurance)

- The home being purchased would meet HUD’s property requirements or minimum property standards (this helps keep the home safe for occupants)

Learn what your down payment would be using our Reverse for Purchase calculator. Or, get pre-approved today »