By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

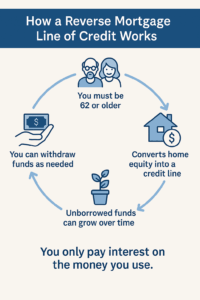

If you’re considering a reverse mortgage, you may have heard about the reverse mortgage line of credit. This option allows seniors to tap into their home’s equity, but it works a bit differently from the traditional reverse mortgage model.

In this guide, we’ll explain how a reverse mortgage line of credit works, its unique benefits, and why it could be the right solution for seniors who want a flexible source of income. We’ll also explore how this option differs from other reverse mortgage products and the key benefits it offers over time.

What Is a Reverse Mortgage Line of Credit?

A reverse mortgage line of credit offers several important advantages for seniors seeking flexibility in their financial planning.

The main benefit is control. Unlike lump-sum or monthly payout options, this line of credit lets you borrow only what you need, when you need it. That makes it ideal for handling unexpected expenses, future healthcare costs, home repairs, or any situation where gradual access to funds is more useful than receiving a large amount upfront.

Another key advantage is that no monthly payments are required. Just like other reverse mortgage products, the loan is repaid only when you sell the home, move out, or pass away—allowing you to use your equity without adding financial stress.

What makes this option even more valuable is that your line of credit can grow over time. Based on your home’s value and the interest rate, your available funds may increase—giving you a growing financial cushion as long as you remain in your home.

For some seniors, this added equity can also help with plans to downsize or relocate. Finally, the money you withdraw is generally tax-free, which is a major benefit for those living on a fixed income.

How It Works

With a reverse mortgage line of credit, you can access your home’s equity in the form of a revolving line of credit. This means you can take money out when necessary and leave the rest of the credit available for future use.

Here’s how it works:

- You don’t make any monthly payments. The loan is repaid when you sell the home, move out, or pass away.

- The credit grows over time, based on the value of your home and the interest rate.

- You can borrow as needed — and even pay back some of the amount if you prefer.

- The line of credit is typically available for as long as you live in the home.

This flexibility makes it a great option for seniors who want to have control over their finances and don’t need a large lump sum of money upfront.

Key Benefits of a Reverse Mortgage Line of Credit

A reverse mortgage line of credit offers many advantages for seniors looking for flexibility in their financial planning. The most significant benefit is flexibility itself. With a line of credit, you only borrow what you need, when you need it. This is ideal for covering unexpected expenses or planning for future healthcare costs, home repairs, or other needs.

Another important advantage is that, like other reverse mortgages, there are no monthly payments required. Instead of having to worry about monthly obligations, the loan balance increases over time, but you don’t make any payments until you sell the home or move out.

The line of credit also grows over time based on the value of your home and the interest rate. This means that, as long as your home appreciates, the amount you can borrow increases as well, providing you with a growing financial cushion. Moreover, the funds you withdraw from a reverse mortgage line of credit are generally tax-free, which can be a huge advantage for seniors on a fixed income.

Are You Eligible for a Reverse Mortgage?

(Find out in 60 seconds)

How Does It Differ from Other Reverse Mortgage Options?

While the reverse mortgage line of credit is a flexible option, it differs from other types of reverse mortgages in several key ways:

- Lump Sum vs. Line of Credit

With a traditional reverse mortgage, you typically receive a lump sum payment upfront. In contrast, the line of credit option gives you a revolving credit that you can use as needed.

- Predictable Payments vs. Flexibility

Traditional reverse mortgages often offer monthly payments to the homeowner, which may be ideal for those who need a consistent source of income. On the other hand, a line of credit gives you more control over how much you withdraw and when, making it a great option for those who want to manage their spending more flexibly.

- Interest Accumulation

Both types of reverse mortgages accumulate interest over time, but with a line of credit, the credit line grows over time, whereas a lump sum payment does not.

Potential Risks to Consider

While the reverse mortgage line of credit offers flexibility, keep these key risks in mind:

Growing loan balance: Interest and fees compound over time without monthly payments, eating into your home equity and reducing what you leave to heirs.

Homeowner obligations: You must still pay property taxes, insurance, and maintain the home. Miss these, and the loan becomes due immediately.

Credit limitations: Your available funds depend on home value, age, and interest rates—market dips can shrink your credit line.

Upfront costs: Origination fees, mortgage insurance, and closing costs get added to your loan balance, meaning you pay interest on the fees themselves.

Talk to a Reverse Mortgage Specialist

At South River Mortgage, we specialize in helping seniors access the benefits of reverse mortgages, including jumbo reverse mortgages. Our team is ready to walk you through your options, ensuring you make an informed decision that’s right for you.

📞 Call us now for a free consultation: (844) 230-6679