Colorado Reverse Mortgage Lenders

Trusted Colorado reverse mortgage lender. Unlock retirement cash with an FHA-insured HECM—no payments, no stress. A+ BBB rating.

Reverse Mortgage Product Options in Colorado

| HomeForLife | HECM | |

| Traditional Reverse Mortgage (Reverse Mortgage 101) | Yes | Yes |

| Refinance Existing Reverse Mortgage with Another (HECM to HECM) | Yes | Yes |

| Purchase a Home with a Reverse Mortgage (HECM for Purchase) | Yes | Yes |

| Minimum Age for Eligibility in CO | 55 | 62 |

| Get Your Quote → | Get Your Quote → |

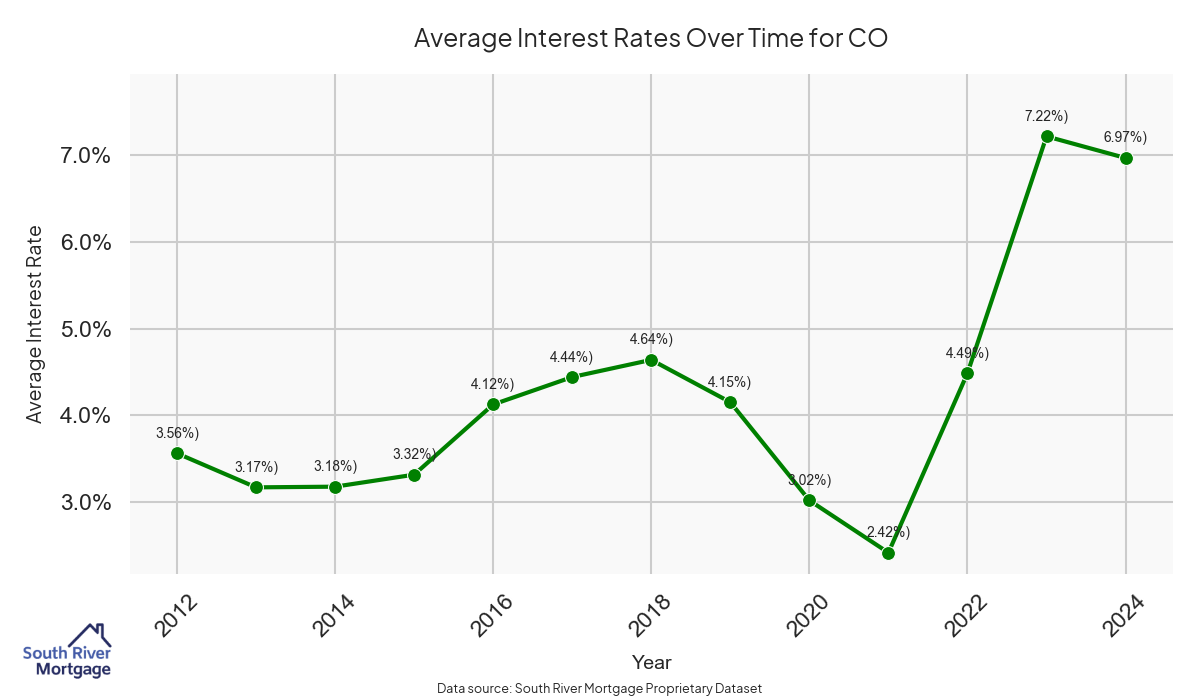

Reverse Mortgage Interest Rates in Colorado

As of today, the 10-year CMT index is trading at 4.00%. Reverse mortgage interest rates adjust weekly on Tuesdays, so the next adjustment date will be Tuesday, November 4, 2025. (Updated 3 November 2025)

The projected index for next week is 4.00%, compared to this week’s index, which is 4.00%. This means that rates are projected to be between 5.75% and 6.50%.

Click to learn more about Reverse Mortgage Interest Rates (& how they affect you) →

Local Reverse Mortgage Lenders in Colorado

Although South River Mortgage originates loans all across the country, we do maintain a local presence in Colorado. We have a resident agent location at 36 South 18th Avenue, Suite D, Brighton, CO 80601. Get Your Quote →

HUD also maintains a list of local lenders. Get Your Quote →

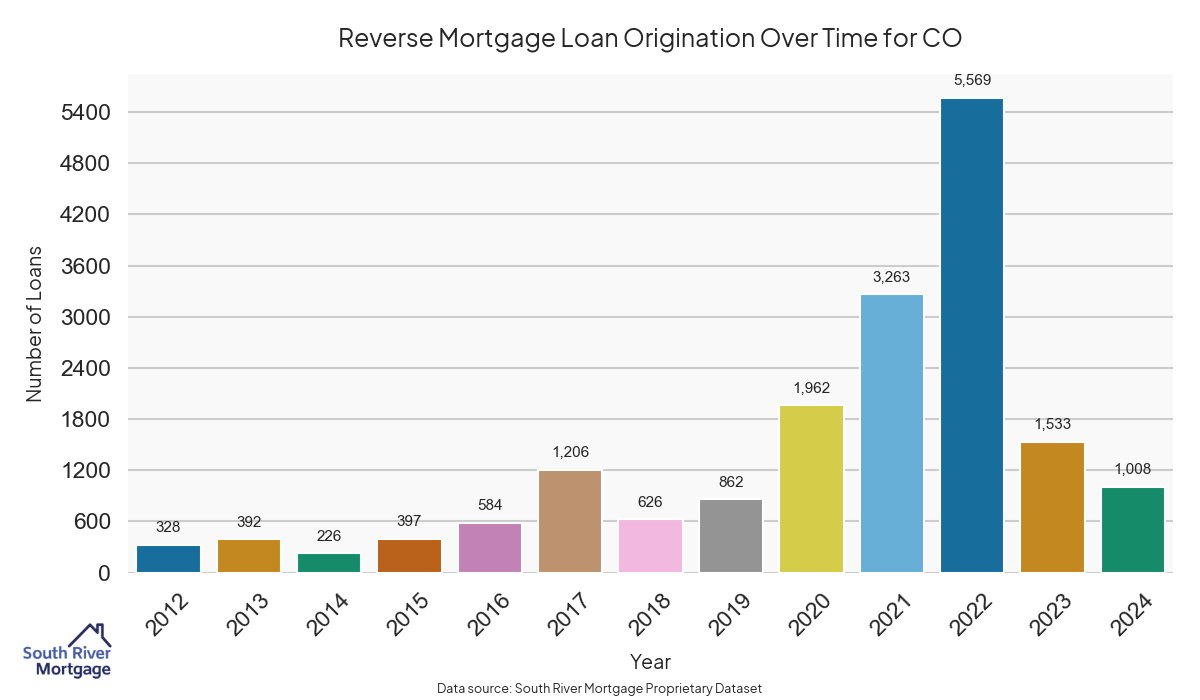

Reverse Mortgage Loan Origination Statistics in Colorado

We have pulled together a number of useful reverse mortgage loan statistics for CO. These loan origination statistics are put together below as a courtesy, and as such, we cannot make any guarantees about the accuracy of the information.

Note that this data was sourced from a proprietary data set, so it includes loans outside of the FHA HECM loans listed on the HECM Portfolio Snapshot.

Reverse Mortgages in Colorado

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

.

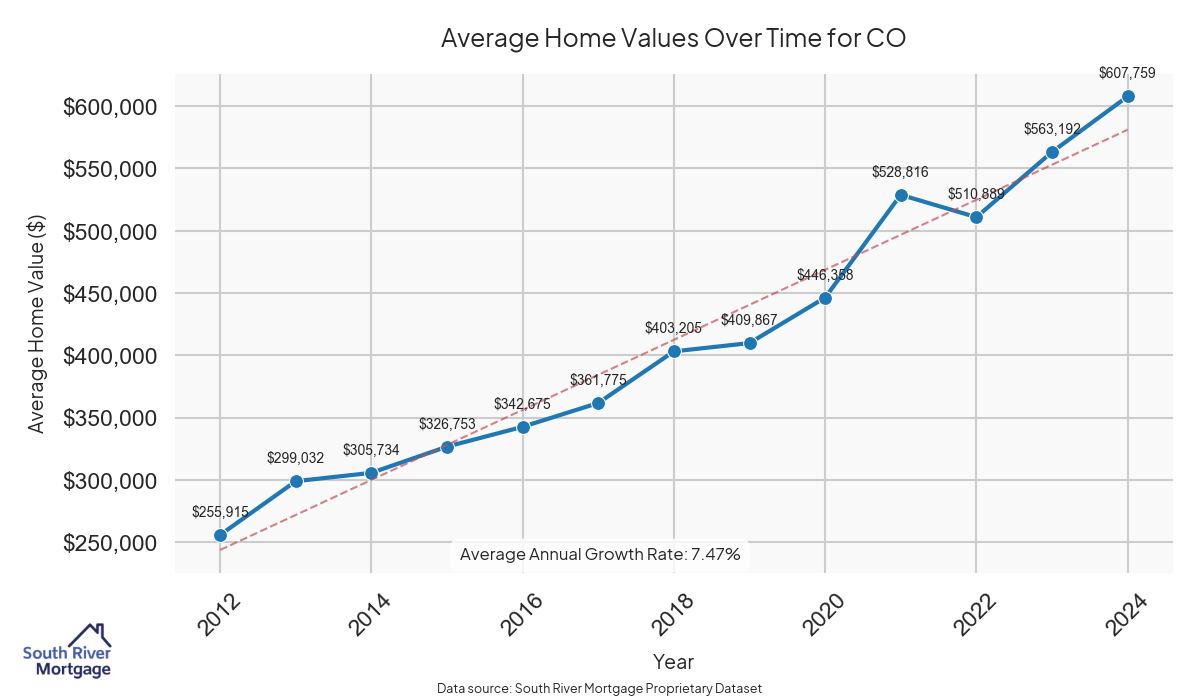

Average Reverse Mortgage Home Values in Colorado

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

Reverse Mortgage Interest Rates in Colorado

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

State Regulator & Licensing in Colorado

Make sure you are working with a licensed mortgage lender in Colorado. South River Mortgage maintains approval with Colorado and holds the Mortgage Company Registration NMLS ID 1854524.

County-Specific Loan Information in Colorado

Colorado has 49, and each county has its own specifics. We have compiled county-by-county loan statistics and information, whether you are looking for a reverse mortgage or just curious about loan origination activity. Kindly note that this information is provided on a best-efforts basis – and while we do as much quality control work as possible – we make no guarantees to the accuracy of loan statistical information provided

Choose any county to learn more about reverse mortgages in that area:

- Adams County

- Alamosa County

- Arapahoe County

- Archuleta County

- Bent County

- Boulder County

- Broomfield County

- Chaffee County

- Cheyenne County

- Clear Creek County

- Custer County

- Delta County

- Denver County

- Douglas County

- Eagle County

- Elbert County

- El Paso County

- Fremont County

- Garfield County

- Gilpin County

- Grand County

- Gunnison County

- Huerfano County

- Jefferson County

- Lake County

- La Plata County

- Larimer County

- Las Animas County

- Lincoln County

- Logan County

- Mesa County

- Moffat County

- Montezuma County

- Montrose County

- Morgan County

- Otero County

- Ouray County

- Park County

- Pitkin County

- Prowers County

- Pueblo County

- Rio Blanco County

- Rio Grande County

- Routt County

- Saguache County

- Summit County

- Teller County

- Weld County

- Yuma County