By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

Why Reverse Mortgages Are Popular in Texas

Texas has become one of the leading states for reverse mortgages. Home values have climbed steadily, the retiree population continues to grow, and many homeowners want to stay in their homes without draining their savings.

A reverse mortgage gives seniors a way to use their equity while keeping ownership of their home.

For Texans with strong home equity, this can be a practical way to cover rising living costs, healthcare needs, or home repairs without taking on monthly payments.

If you’re a homeowner in Texas, especially in your golden years, you might be considering a reverse mortgage to boost your retirement income. But how does it work in Texas, and what makes this state unique for reverse mortgage eligibility?

In this quick guide, we’ll break down everything you need to know about reverse mortgages in the Lone Star State. We’ll discuss eligibility, benefits, and some Texas-specific considerations like home values, senior demographics, and loan rates.

What Is a Reverse Mortgage?

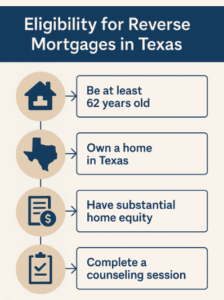

Before we dive into the specifics for Texas, let’s do a quick recap of what a reverse mortgage is. Simply put, a reverse mortgage allows homeowners aged 62 or older to convert part of their home equity into cash — without selling their home or making monthly mortgage payments.

👉 Learn more about how reverse mortgages work.

The most common type of reverse mortgage is the Home Equity Conversion Mortgage (HECM), which is insured by the federal government. With a reverse mortgage, the lender makes payments to you, and the loan is repaid when you sell the home, move out, or pass away.

How a Reverse Mortgage Fits the Needs of Texas Homeowners

Many Texas retirees want to stay close to family, enjoy familiar communities, and avoid the cost and stress of moving. A reverse mortgage can help make that possible by providing extra income while allowing seniors to keep living in their homes.

Because Texas has higher-than-average property sizes and strong equity growth, many homeowners find they qualify for more than they expect.

How Reverse Mortgages Work in Texas

Texas is one of the most popular states for reverse mortgages, thanks to the state’s growing retiree population and rising home values. If you own your home outright or have a significant amount of equity, you may qualify for a reverse mortgage.

To qualify, your home must meet certain requirements:

- Be built after June 15, 1976, conforming to HUD’s manufactured housing construction code.

- Be classified as real property — meaning it’s permanently affixed to land that you own.

- Have a foundation that meets FHA guidelines to ensure stability and safety.**

- Be your primary residence where you live most of the year.

- Meet all local zoning and building codes

Texas Property Rules You Should Know

Texas has stricter property rules than most states. These guidelines protect homeowners, but they can also affect eligibility.

A few key points include:

- Your home must sit on land that you own

- The property must be considered your permanent home, not a vacation or secondary home

- You must keep the home in good condition under Texas homestead guidelines

These rules help ensure that the home remains safe, stable, and qualified for reverse mortgage benefits.

Why Texas Is a Great Place for Reverse Mortgages

Texas has experienced substantial growth in home values, particularly in cities like Austin, Dallas, and Houston.

👉 Explore reverse mortgage options for high-value Texas homes.

- Rising Home Values: Texas has experienced substantial growth in home values, particularly in cities like Austin, Dallas, and Houston. As a result, homeowners can unlock significant equity through reverse mortgages, especially in growing metro areas.

- Large Senior Demographic: Texas has one of the fastest-growing senior populations in the U.S. According to the Texas Department of Aging and Disability Services, the number of residents aged 65 and older is expected to double by 2050. This growth contributes to the demand for reverse mortgages as a solution for retirees seeking to increase their cash flow.

- No State Income Tax: Texas is one of the few states without a state income tax, making reverse mortgages an attractive option for seniors who want to maximize their retirement funds.

Are You Eligible for a Reverse Mortgage?

(Find out in 60 seconds)

How Larger Lot Sizes Impact Texas Reverse Mortgages

Texas is known for larger properties, rural acreage, and wider lot sizes. These features often raise a home’s value, which can increase how much equity a homeowner can use in a reverse mortgage.

In rural or semi-rural areas, the value of the land itself can make a big difference in eligibility and loan proceeds. This is one reason reverse mortgages are used across the state, not just in big metro areas.

Understanding Reverse Mortgage Loan Rates in Texas

When considering a reverse mortgage, reverse mortgage loan rates are a crucial factor to understand. These rates depend on several things, including the type of reverse mortgage (HECM or private loan); the current interest rate environment (whether rates are higher or lower at the time of borrowing) or the homeowner’s age and property value.

In Texas, reverse mortgage loan rates are typically competitive, but like any loan, they can vary from lender to lender. It’s essential to shop around and compare rates to ensure you’re getting the best deal.

How Texas Markets Influence Your Loan Options

Different regions in Texas can affect how much you may qualify for.

For example:

- Austin and Dallas often have fast-rising home values

- Houston and San Antonio tend to have steady, long-term price growth

- Rural areas sometimes have lower home values but may still qualify depending on acreage and improvements

Because of these differences, it’s important to review your specific area’s market trends when exploring a reverse mortgage.

Talk to a Reverse Mortgage Expert

If you are considering a reverse mortgage in Texas, it is important to understand how state rules and local property values affect your eligibility.

Our team can walk you through Texas-specific guidelines, review your home’s equity, and explain current loan options in simple terms.

Call (844) 230-6679 to speak with a licensed advisor and get a clear explanation of your choices.

FAQ: Reverse Mortgages in Texas

Are reverse mortgages legal in Texas?

Yes. Texas has approved reverse mortgages since 1999 and has some of the strongest homeowner protections in the country.

Do Texas homestead rules affect eligibility?

Yes. Your home must be your primary residence and meet all homestead requirements.

Can I get a reverse mortgage on a rural property or acreage?

Often yes. The land must be part of your primary residence, but many Texas rural properties qualify.

Do I still pay property taxes and insurance?

Yes. You must keep taxes, insurance, and maintenance up to date to stay in good standing.

Will my heirs still receive the home?

Yes. Your heirs can keep the home by paying off the loan or they can sell it. Remaining equity goes to them.