By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

For many seniors, a reverse mortgage is a helpful tool to unlock home equity and provide a steady income stream during retirement. But what happens when circumstances change? Can you refinance a reverse mortgage?

In this detailed guide, we’ll explore the reverse mortgage refinancing process, explain the eligibility requirements, and discuss the benefits and risks of refinancing. Whether you want to lower your loan balance, access more equity, or change the terms of your reverse mortgage, we’ve got all the information you need to make an informed decision.

Why Seniors Refinance Their Reverse Mortgage

A reverse mortgage isn’t a “one-and-done” decision. As your home value changes, interest rates shift, or your needs evolve, refinancing can give you better terms than you had before.

Some seniors refinance simply to lower costs, while others want more flexibility in how they receive their funds.

A refinance gives you the chance to update your loan so it fits your current retirement needs—not the needs you had years ago.

What Is a Reverse Mortgage?

Before diving into the specifics of refinancing, let’s briefly review what a reverse mortgage is. A reverse mortgage allows homeowners aged 62 or older to access the equity in their homes without making monthly mortgage payments. Instead, the lender makes payments to the homeowner, and the loan is repaid when the homeowner sells the home, moves out, or passes away.

The most common type of reverse mortgage is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration (FHA). There are also jumbo reverse mortgages for homes that exceed the FHA limits.

Can You Refinance a Reverse Mortgage?

Yes, you can refinance a reverse mortgage, but there are specific requirements and considerations you need to be aware of. Refinancing a reverse mortgage is similar to refinancing a traditional mortgage, but there are some key differences due to the unique nature of reverse mortgages.

You might consider refinancing a reverse mortgage for several reasons:

- Access More Equity: If your home has appreciated in value since your initial reverse mortgage was taken out, you might be able to access more equity by refinancing.

- Lower Interest Rates: If interest rates have dropped since you took out your reverse mortgage, refinancing could allow you to secure a lower rate, which may lower your loan balance over time.

- Change Loan Terms: You might want to adjust the payment structure, for example, switching from a lump sum to monthly payments or a line of credit.

- Lower Fees: Refinancing might help you reduce fees or get better loan terms than before.

However, refinancing may not be the right option for everyone. Let’s take a look at the process and requirements.

When Refinancing Makes the Most Sense

While there are several reasons to refinance, a few situations make refinancing especially helpful:

- Your home value has increased

- You originally locked in a higher interest rate

- You want to switch from a lump sum to a line of credit

- You need more long-term financial flexibility

- You now qualify for better terms because of your age

If one or more of these apply, refinancing can open the door to more funds or lower costs.

How Does Refinancing a Reverse Mortgage Work?

The process for refinancing a reverse mortgage is straightforward but requires several key steps. First, you must meet the same eligibility requirements as the original reverse mortgage. You must be 62 years or older, your home must be your primary residence, and you need sufficient equity in the home.

Next, you’ll need an appraisal to determine your home’s current value, and the lender will review your financial situation. Like the original loan, refinancing comes with fees such as closing costs and an appraisal fee, which can be rolled into the new loan balance.

When you refinance a reverse mortgage, the lender will establish new loan terms based on your home’s current value and your financial situation. This could mean a higher loan balance or more cash available to you, depending on the terms.

Example: How Refinancing Can Increase Your Funds

Imagine you took out a reverse mortgage at age 62, when your home was worth $300,000.

Now you’re 72, and your home is worth $400,000. Interest rates are also lower than before.

By refinancing, borrowers in this situation often unlock:

- A higher principal limit because of increased age

- More available equity because of a higher home value

- A potentially lower interest rate

This combination can significantly increase the amount of money available—or reduce how quickly the balance grows.

Benefits of Refinancing a Reverse Mortgage

Refinancing a reverse mortgage can offer several advantages, especially if your home’s value has increased or interest rates have dropped. If your home has appreciated in value, refinancing can allow you to access more equity, which can be used for a variety of financial needs, including healthcare or home improvements.

Another benefit of refinancing is the opportunity to secure a lower interest rate. If rates have dropped since you first took out your reverse mortgage, refinancing may allow you to lock in a better rate—potentially reducing your overall loan balance over time.

Refinancing can also offer greater flexibility in how you receive your funds, such as switching from a lump sum to monthly payments or a line of credit. In some cases, it may even support your plans for relocation or downsizing.

Are You Eligible for a Reverse Mortgage?

(Find out in 60 seconds)

Additional Advantages Many Borrowers Don’t Know About

Refinancing a reverse mortgage can also help you:

- Add or remove a borrower from the loan

- Update the loan to better protect a non-borrowing spouse

- Switch from a fixed-rate loan to an adjustable rate with a growing line of credit

- Re-set your loan terms to match your updated retirement plans

These updates can give you more control and stability as your needs change later in life.

Potential Risks and Considerations of Refinancing

While refinancing can be beneficial, there are some risks and considerations to keep in mind. Refinancing can often result in a higher loan balance, as any closing costs or fees associated with refinancing are usually rolled into the loan. This means that while you may access more cash or lower your monthly payments, your loan balance could increase over time.

Additionally, refinancing typically comes with higher fees, including appraisal and closing costs. These costs can add up, and it’s important to weigh them against the benefits of refinancing to ensure it makes financial sense. Another consideration is the possibility of paying more interest over the life of the loan. Extending the loan term or withdrawing more equity could result in more interest being paid.

When Refinancing May Not Be Worth It

A refinance might not be the right move if:

- You plan to move within the next few years

- Closing costs outweigh the benefits you’d receive

- Your home value hasn’t increased enough

- Interest rates have risen since your original loan

- You don’t need additional funds or new terms

A lender can help you compare your current loan with a new one to see if refinancing actually puts you in a better position.

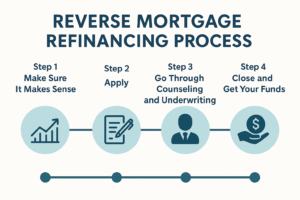

The Refinancing Process: Step-by-Step

Refinancing a reverse mortgage involves several steps:

1. Assess Your Financial Situation: Before refinancing, make sure you understand your financial needs and goals.

2. Find a Lender: Not all lenders offer reverse mortgage refinancing. It’s important to find one that specializes in reverse mortgage products.

3. Appraisal: Your lender will schedule an appraisal to determine your home’s current market value.

4. Review Terms and Fees: Make sure to review the new loan terms and associated fees. These could include new closing costs, administrative fees, and possibly higher loan balances.

5. Close the Loan: If you decide to proceed with refinancing, you’ll go through the closing process, which includes paying any fees and signing the new loan documents.

Questions to Ask Before Refinancing

Before moving forward, it helps to answer a few key questions:

- How much more money would I receive under a refinance?

- Are interest rates today better or worse than when I first applied?

- Do I want a different payout method, such as a line of credit?

- Will refinancing increase my long-term loan balance?

- How long do I plan to stay in my home?

These questions can help you determine whether refinancing moves you closer to your retirement goals.

Talk to a Reverse Mortgage Specialist

Refinancing a reverse mortgage can be a smart way to access more equity, lower your costs, or update your loan to better match your retirement plans. Our licensed specialists can compare your current loan with today’s options and show you how much you may qualify for under a refinance.

Call (844) 230-6679 to get clear, personalized guidance on whether refinancing makes sense for you.

FAQ: Refinancing a Reverse Mortgage

How soon can I refinance my reverse mortgage?

Most borrowers can refinance after 18 months, but your lender will confirm eligibility.

Do I need another appraisal?

Yes. A new FHA appraisal is required to determine your home’s current value.

Can refinancing lower my interest rate?

Yes, if today’s rates are lower than when you first took out the loan.

Will my closing costs be high?

Costs vary, but many borrowers roll fees into the new loan to avoid paying upfront.

Do my heirs still receive remaining equity after refinancing?

Yes. Any equity left after the loan is repaid goes to your heirs, just like with any reverse mortgage.