By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

As home values rise, more and more homeowners are considering jumbo reverse mortgages. If you own a high-value property and are 62 years or older, a jumbo reverse mortgage could help you access your home’s equity and improve your cash flow without selling your home.

In this post, we’ll explore what a jumbo reverse mortgage is, how it differs from traditional reverse mortgages, and the eligibility requirements you need to meet. We’ll also look at the benefits and risks of this loan option, so you can make an informed decision.

Why Jumbo Reverse Mortgages Are Becoming More Common

Home prices have climbed quickly in many areas, and more properties now fall above the FHA loan limit. Because of this, many homeowners find that a standard reverse mortgage doesn’t give them access to all the equity they’ve built.

A jumbo reverse mortgage fills that gap. It lets you tap into more of your home’s value and gives you financial breathing room without selling your home or taking on monthly payments.

For high-value properties, it’s often the only way to unlock the full benefit of your equity.

What Is a Jumbo Reverse Mortgage?

A jumbo reverse mortgage is similar to a traditional reverse mortgage, but it’s designed for homes that exceed the maximum loan limits set by the Federal Housing Administration (FHA) for Home Equity Conversion Mortgages (HECMs).

While HECMs have a limit of around $1 million (depending on your location), jumbo reverse mortgages are available for higher-value homes, which means you can borrow more money against your home’s equity.

Just like a traditional reverse mortgage, the lender makes payments to you, and the loan is repaid when you move out, sell the home, or pass away. The key difference is that jumbo reverse mortgages are not federally insured by the FHA, so they may have different terms and rates.

When a Jumbo Reverse Mortgage Makes the Most Sense

A jumbo loan is particularly helpful if:

- Your home is valued well above the FHA limit

- You need access to a larger amount of cash

- You want more flexibility than a standard reverse mortgage allows

- You have strong credit and can meet the lender’s financial criteria

If your home value is high enough, a jumbo loan may give you far more usable funds than a traditional HECM.

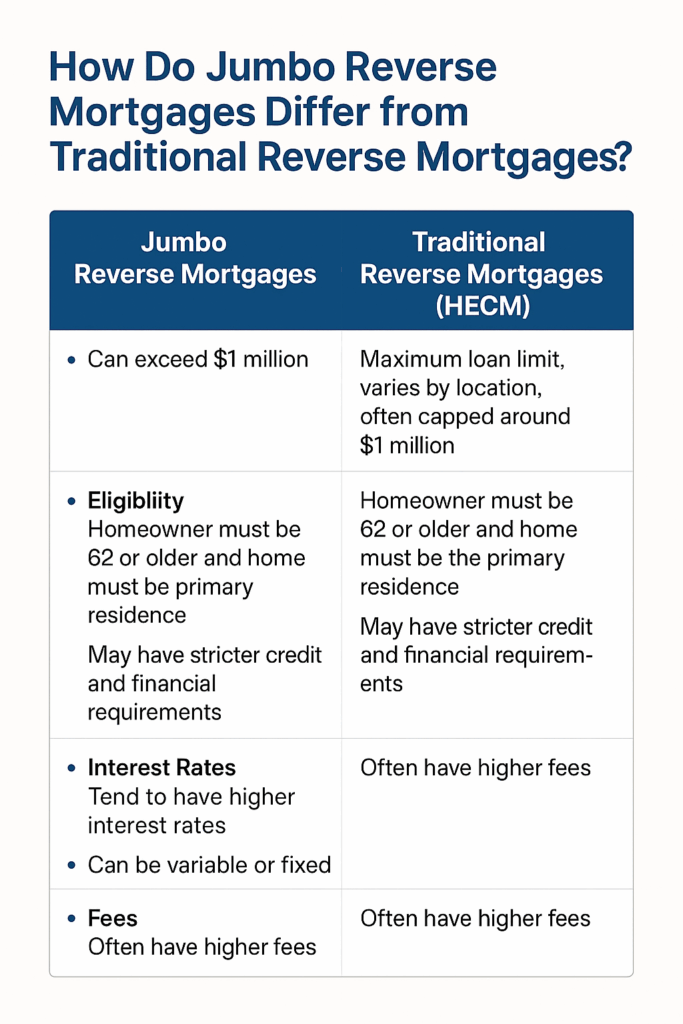

How Do Jumbo Reverse Mortgages Differ from Traditional Reverse Mortgages?

The main difference between a jumbo reverse mortgage and a traditional reverse mortgage (HECM) lies in the loan limits and eligibility criteria. Here’s a quick breakdown:

- Loan Limits: HECMs have a maximum loan limit that varies by location, usually capping around $1 million. Jumbo reverse mortgages, on the other hand, can exceed this limit, allowing homeowners with more expensive properties to access more equity.

- Eligibility: Both loans require the homeowner to be 62 or older and the home must be the primary residence. However, since jumbo reverse mortgages are not federally insured, lenders may have stricter credit and financial requirements.

- Interest Rates: Jumbo reverse mortgages tend to have higher interest rates than HECMs, and these rates can be variable or fixed, depending on the lender and the terms of the loan.

Fees: Jumbo reverse mortgages often have higher fees because they’re non-FHA insured, and the loan terms can be more flexible but come with extra costs

Example: How Much More You May Access With a Jumbo

Consider two homeowners:

- Susan has a home worth $1.8 million

- Bill has a home worth $900,000

Bill may fit under FHA limits and could qualify for a HECM.

Susan’s home is too valuable for a standard reverse mortgage, so a jumbo option could allow her to access several hundred thousand dollars more than a HECM would permit.

This example highlights why jumbo options exist — they help homeowners with higher-value homes access the equity they’ve spent years building.

Benefits of Jumbo Reverse Mortgages

One of the biggest advantages of a jumbo reverse mortgage is the ability to access more equity from higher-value properties. This can provide significant financial flexibility for seniors who want to supplement retirement income, cover healthcare expenses, or make home improvements without monthly payments.

Jumbo reverse mortgages also offer the potential for larger loan proceeds, allowing borrowers to receive a lump sum, line of credit, or monthly payments tailored to their needs. Since these loans are not backed by the FHA, borrowers may find fewer restrictions on loan amounts and more personalized lending options.

Are You Eligible for a Reverse Mortgage?

(Find out in 60 seconds)

Additional Flexibility Many Borrowers Don’t Expect

Because jumbo reverse mortgages are privately funded, lenders often offer features that aren’t available with FHA-backed loans. These may include:

- Higher payout options

- More flexible underwriting

- Shorter or simplified approval timelines

- Options tailored for luxury or unique properties

For some homeowners, these features make a jumbo reverse mortgage easier to qualify for than expected.

Potential Risks and Considerations

While jumbo reverse mortgages offer enticing benefits, they also come with important risks and considerations. Because these loans are privately funded, interest rates may be higher than those for FHA-backed HECM loans. Additionally, fees and closing costs can be more substantial.

Borrowers should carefully evaluate their ability to keep up with ongoing costs such as property taxes, homeowners insurance, and maintenance, as failure to meet these obligations can lead to loan default. It’s also important to understand that a jumbo reverse mortgage reduces the equity in the home, which may affect inheritance for heirs.

Questions to Ask Before Choosing a Jumbo Reverse Mortgage

A jumbo reverse mortgage can be helpful, but it’s important to think through a few key questions:

- Will the higher interest rate impact how much equity is left for heirs?

- Do I understand all fees and closing costs?

- Can I keep up with taxes, insurance, and home maintenance?

- Am I planning to stay in my home long enough for the loan to make sense?

- Would a standard HECM meet my needs at a lower cost?

These questions help you decide whether a jumbo product fits your long-term plans.

Should You Consider a Jumbo Reverse Mortgage?

If you have a high-value home and need extra retirement income, a jumbo reverse mortgage could be a good fit. However, it’s important to weigh the benefits against the potential risks, especially considering the higher loan costs, fees, and interest rates.

Before making a decision, consult with a trusted reverse mortgage advisor who can explain the terms, help you understand reverse mortgage loan rates, and help you find the best option for your situation.

Talk to a Reverse Mortgage Expert

If you’re considering a jumbo reverse mortgage, it’s important to understand how it compares to a traditional HECM and what the differences mean for your financial future.

Our specialists can walk you through current rates, available loan amounts, and what you may qualify for based on your home’s value.

Call (844) 230-6679 to speak with a licensed advisor and get a clear explanation of your options.

Or click here to get an instant quote on your current property.

FAQ: Jumbo Reverse Mortgages

How much can I borrow with a jumbo reverse mortgage?

It depends on your home’s value, age, and lender guidelines. Many jumbo programs offer limits well above FHA caps.

Are jumbo reverse mortgages insured by the government?

No. They are privately funded, which is why terms and rates vary by lender.

Do jumbo reverse mortgages have higher rates?

Often yes, because they don’t have FHA insurance. A specialist can compare your options.

Do I still own my home?

Yes. You keep the deed, just like with any reverse mortgage.

Can my heirs still inherit the home?

Yes. Your heirs can pay off the loan or sell the property. Any remaining equity goes to them.