Reverse Mortgage Lenders in San Joaquin County, California – 2025

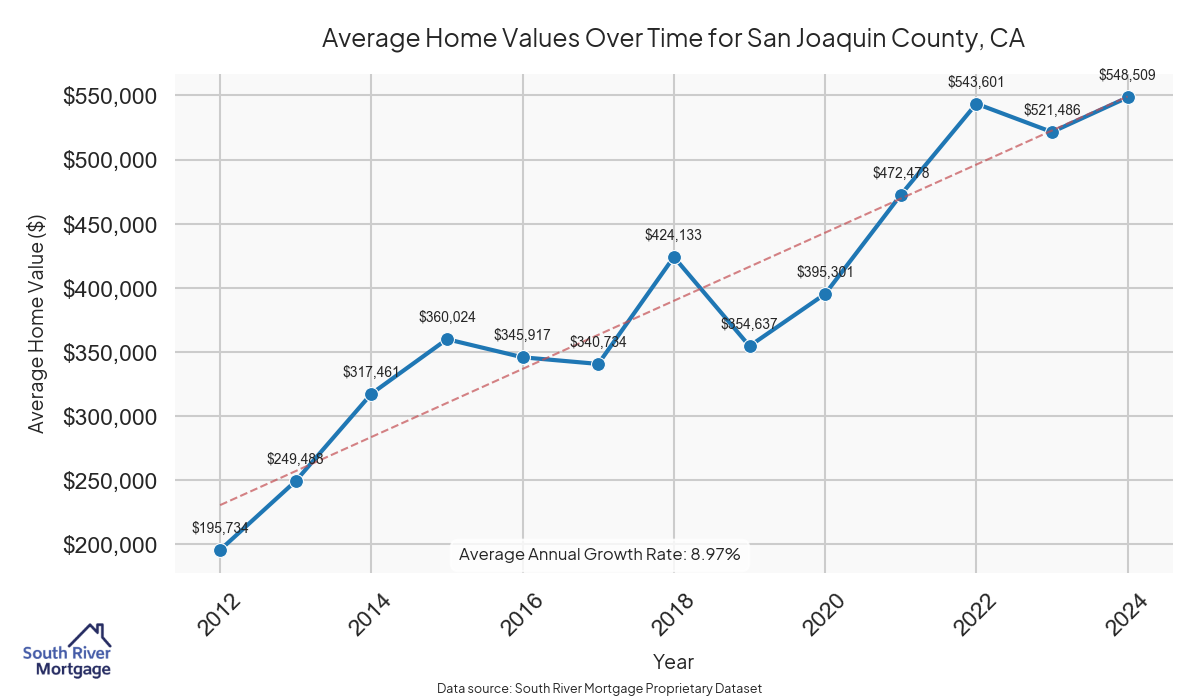

In 2024, there were 860 active reverse mortgage loans in San Joaquin County, California. The average home value in San Joaquin County is $549,000.88.

Click here to get a reverse Mortgage Quote in San Joaquin County, California

To avoid scams, make sure you are working with a licensed lender in California. South River Mortgage is a fully licensed lender in California. The CA state regulator requires mortgage lenders to be explicitly approved to make loans and hold a license. South River Mortgage proudly holds the California Financing Law License in CA, and our state license identifier is 60DBO-103862. We also maintain active approval with HUD/FHA.

Reverse Mortgage Loans in San Joaquin County

San Joaquin County is located in the state of California and is known for its diverse agriculture, particularly its production of fruits, vegetables, and dairy products. With a population of around 750,000 residents, the county enjoys a Mediterranean climate characterized by hot, dry summers and mild, wet winters. San Joaquin County has a rich history, with some of its cities dating back to the mid-19th century during the California Gold Rush era. The average home value in San Joaquin County is approximately $549,000.8767, with an average property tax of $3487.178186, and an average interest rate of 0.04104230769. Seniors in San Joaquin County may benefit from considering a reverse mortgage, a financial tool that allows homeowners aged 62 and older to access the equity in their homes to supplement their income in retirement. This can be especially helpful for seniors who own their homes outright and are looking for additional sources of funds to support their living expenses.

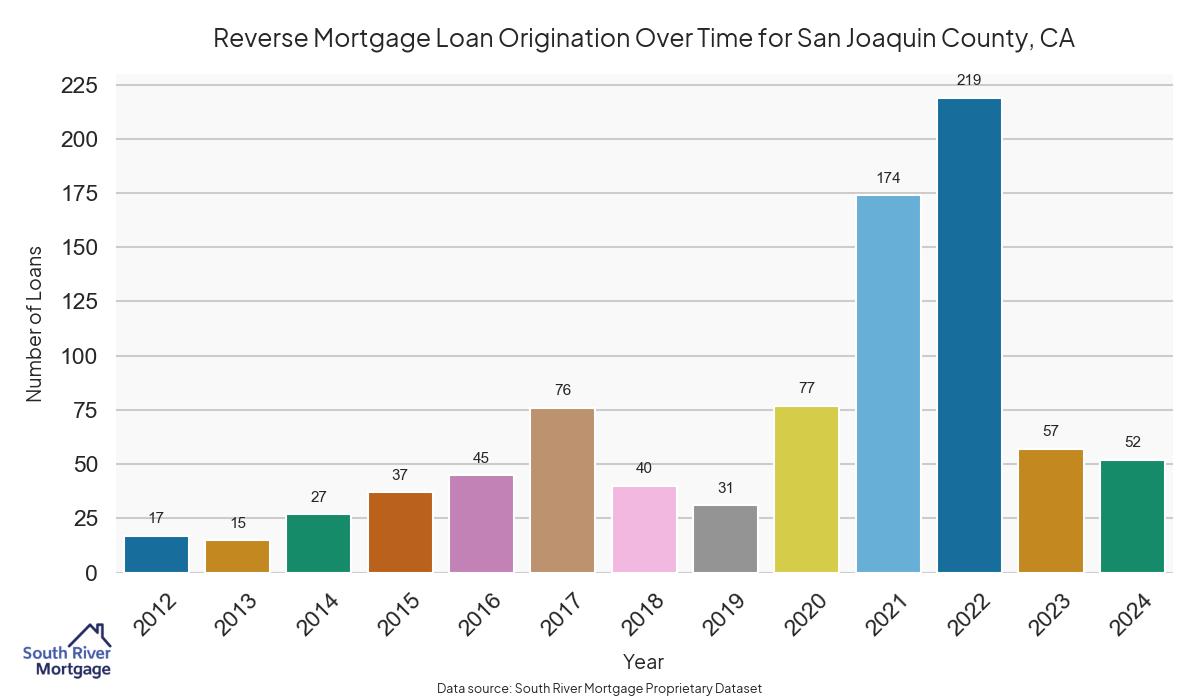

Reverse Mortgage Loan Origination in San Joaquin County

Reverse Mortgage Home Values in San Joaquin County

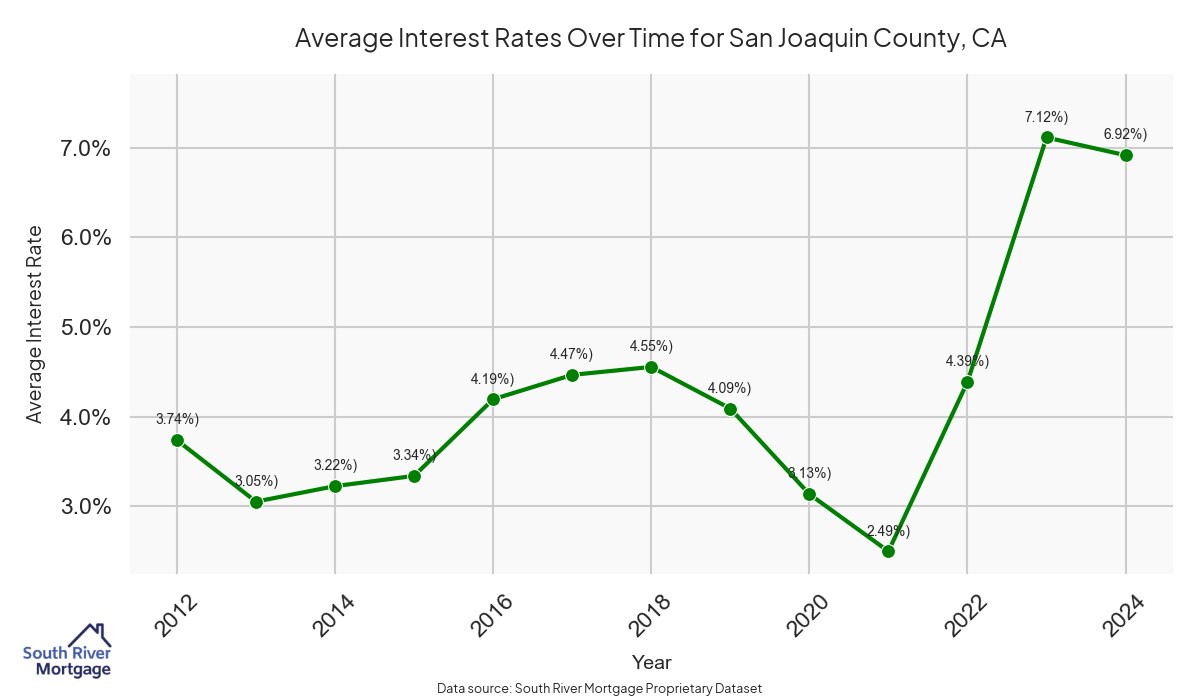

Reverse Mortgage Interest Rates San Joaquin County

There are approximately 860 active reverse mortgage loans in San Joaquin County. The average interest rate in San Joaquin County is 7.31% for reverse mortgages. The average maximum claim amount (the lesser of the appraisal or lending limit), among reverse mortgage borrowers, in San Joaquin County was $550,000.00 in 2024.

Click here to get a Reverse Mortgage Quote in San Joaquin County, California »

Note that our loan origination data will not exactly match FHA’s HECM portfolio snapshot. This discrepancy occurs because FHA’s reports are limited to loans endorsed by FHA (i.e. HECMs only). We use a series of custom data criteria that make it possible to identify all reverse mortgages: HECMs, proprietary, and even single-purpose reverse mortgages.

| San Joaquin County, CA Facts – As of 2025 | |

| Average property value (estimated) | $550,000.00 |

| Average property taxes | $3,487.18 |

| Average reverse mortgage interest rate | 7.31% |

| Area median income | $100,300.00 |

Data Source: FFIEC HMDA Data

Jumbo Reverse Mortgage in San Joaquin County, CA

With the average home value of $550,000.00, you may be wondering about the opportunities for jumbo loans.

| HomeForLife | HECM | |

| Traditional Reverse Mortgage | Yes | Yes |

| Refinance Existing Reverse Mortgage with Another (HECM to HECM) | Yes | Yes |

| Purchase a Home with a Reverse Mortgage (HECM for Purchase) | Yes | Yes |

| Minimum Age for Eligibility in CA | 55 | 62 |

| Get Your Quote → | Get Your Quote → |

The FHA has increased the HECM lending limit to $1,209,750 for 2025. If your property is valued above the HECM lending limit, you may be eligible for additional proceeds through the HomeForLife jumbo reverse mortgage.

Reverse Mortgage Refinance (HECM to HECM) in San Joaquin County

It might make sense to refinance your reverse mortgage. There are many situations where refinancing could be very beneficial to you:

- You want to get more cash out because your home value has increased substantially

- You want to pay less in interest by obtaining a lower interest rate

- You want to add a loved one to the reverse mortgage

As a bonus, South River Mortgage can sometimes provide multiple benefits at once, depending on the situation. There have been cases where we can help secure a lower interest rate and additional cash. In some cases, we have been able to do all three benefits: lower rate, more cash, and adding a son or daughter onto the mortgage.

South River Mortgage can help you refinance your reverse mortgage. Get a quote today »

Reverse for Purchase (HECM for Purchase) in San Joaquin County

You can now purchase a home with a reverse mortgage in {county}, CA. The reverse for purchase lets homebuyers purchase the home and get a reverse mortgage in a single transaction. The requirements for a reverse for purchase are very similar to the traditional reverse mortgage program.

Purchasing a home with a reverse mortgage has many benefits:

- No monthly mortgage payment (although you’d still be responsible for property taxes and homeowner’s insurance)

- The home being purchased would meet HUD’s property requirements or minimum property standards (this helps keep the home safe for occupants)

Learn what your down payment would be using our Reverse for Purchase calculator. Or, get pre-approved today »