For years condominium owners have been denied from reverse mortgages due to strict Federal Housing Administration (FHA) guidelines. Fortunately, as of October 15, 2019, newly revised FHA policies were implemented to reduce barriers and increase the likelihood of applicant eligibility.

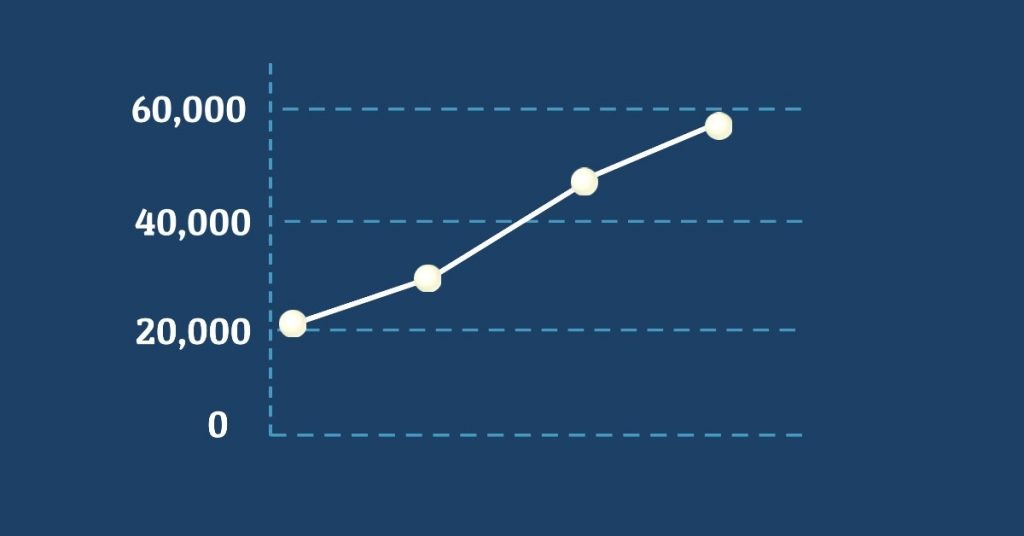

The FHA estimates to qualify 20,000-60,000 more condos with updated guidelines (Source: HUD)

Previously, less than 10% of condos in the country were approved; with these new policies the FHA is confident that the number of FHA approvals will significantly increase.

Prior to applying for a reverse mortgage, condominium owners should determine whether or not their condo is already FHA approved. To do so, potential borrowers can simply visit the HUD website and enter some simple property information.

If the condo is approved, then the borrower is ready to move forward in completing the application. However, more often than not, condo associations do not have up-to-date approvals. If this is the case, borrowers can take one of two routes. They can either approach the Homeowner Association (HOA) and inquire about renewing the condominium’s FHA approval or receive FHA single unit approval (previously ‘spot approval‘).

While condo associations tend to be hesitant, if a number of condominium owners are interested in acquiring reverse mortgages, the HOA may be more inclined to pursue an updated approval. The 2-4 weeks process typically costs the HOA between $700-$900 and does not guarantee approval. However, when approval is granted, the new guidelines increased the life of an FHA approval from two to three years. When it comes to denial, most of the issues encountered are fixable.

Qualifications to get a reverse mortgage on condos

Updated FHA approval requirements/restrictions are as follows:

- The condominium project must contain at least 2 dwelling units and be primarily residential.

- At least 50% of the units must be owner-occupied.

- A maximum of 35% of the total floor area of the property may be used for non-resident or commercial purposes.

- A single investor may own no more than 10% of the units.

- No more than 15% of the total units may be more than 60 days overdue on their condominium payments.

- The condo must allow leasing.

- The condo may not have a seasoning clause in place.

- At least 10% of the budget must be used to fund a savings account.

- A maximum 50% of units in a project may be FHA-insured.

Despite residential interest, many HOAs are still unwilling to devote the time, effort and money required to obtain FHA approval. When met with this aversion, borrowers may take the alternate route of receiving single unit approval. This allows the funding of FHA loans, such as reverse mortgages, to take place in condominium projects lacking up-to-date FHA approval.

The updated FHA guidelines define the following as eligible single units:

- An individual unit located in a completed condominium project that does not have up-to-date FHA approval.

- No more than 10% of individual condo units can be FHA-insured if the condominium project has 10 or more units.

- No more than 2 individual condo units can be FHA-insured units if the condominium has fewer than 10 units.

It is important to note that condominium associations without FHA approval still need to meet the FHA qualification in order for the borrower to get single unit approval. For this reason, a Direct Endorsement (DE) underwriter must complete a thorough review of the legal, governing and financial documents, as well as maps and insurances. It takes the DE underwriter about 3 weeks to carefully comb through these documents and determine if the property meets the FHA guidelines for approval.

Not long after the new policies were implemented, the number of approved condos and rejected condos were nearly equal. Based on this data, we can conclude that about half of the time borrowers will be denied for single unit approval even with the newly revised guidelines.

Can I Get a Non-Warrantable Condo?

A non-warrantable condo implies that the condo that you’re interested in is not approved by the FHA. In most cases, it is usually because the condo complex does not match up to their standards for various reasons.

If the loan is not eligible to be sold to Fannie Mae or Freddie Mac, then the condo is considered non-warrantable. And this is typically a deal-breaker for a number of reverse mortgaging lenders because they consider financing the mortgage on this property type risky.

Factors that may render a condo unit non-warrantable include if:

- If it is only a new project and/or has yet to be completed.

- A high percentage of the unit occupants are non-owners.

- The owners are yet to receive control of the HOA from the developer.

- Over 10% of the total number of units belongs to a single entity or person.

- Short-term rentals is permitted by the community.

- The developer or building owner is embroiled in some form of litigation.

And this is typically a deal-breaker for a number of reverse mortgage lenders.

For non-warrantable condo lenders, you might be able to get up to 90% loan-to-value (LTV) with no mortgage insurance (MI). However, these are pretty rare.

Loan Limits On Condominiums

As of the year 2020, the Fannie Mae loan limit for condos stands at $510,400 in most parts of the country. Fannie Mae and Freddie Mac are federal establishments that are saddled with the responsibility of setting the rules for 30-year, 20-year, and 15-year fixed-rate loans. They usually have certain requirements for condo loans and a “Fannie Mae approved condo” typically implies that the condo, in that case, has either met or exceeded these requirements. Therefore, it would be eligible for federal fencing.

It is essential to know the base information on condo financing because a significant number of money sources for jumbo loans follow Fannie Mae rules regarding condos. However, if you’re not financing, you do not necessarily have to meet Fannie Mae requirements. But maintaining your condo project under Fannie Mae guidelines is essential. This is because, in the event of trying to sell your condo, your buyer might want a 30-year-fixed-rate loan which is of course the most popular in America. And if your condo doesn’t meet up to Fannie/Freddie guidelines, you would be unable to close the sale.

Insurance Premiums On Condominiums

Condo insurance otherwise known as HO-6 insurance policy usually comes at an average fee of $478 per year. However, this fee is not a flat one and varies significantly depending on the area where you reside and your choice of coverage limits. Condo insurance typically protects the dwellers from damage that occurs to the interior of their housing unit. In addition, an HO-6 policy also covers theft of personal property as well as if a guest sustains an injury while inside the property of the policyholder. Thanks to the financial protection that it offers, most mortgage lenders typically require condo insurance.

Data from the National Association of Insurance Commissioners indicates that the cost difference between the most expensive and the cheapest states regarding condo insurance stands at $720 per year. The table below indicates the average cost of insurance by the state both on a monthly and annual basis. The table also displays the percentage difference in comparison to the national average:

Do I own a condo or a townhouse?

Condominiums are most similar to units in an apartment building; however, condos are owned by the individual, not a landlord. Additionally, condominium owners have full rights to their particular unit and shared rights to the communal spaces in the condominium community. Condo owners pay substantial HOA fees to cover the costs of exterior maintenance, insurance, trash, snow removal, etc.

Townhouses are typically two stories within the unit also owned by the individual. Unlike condos, town-home owners maintain full ownership of the home as well as the land on which the home is situated. This may include a garage, backyard or front yard. Because they are responsible for their own maintenance, town-home owners typically incur lower HOA fees than condo owners.