By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

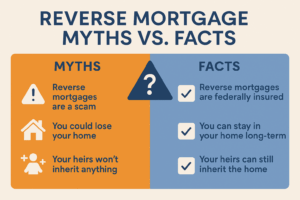

Reverse mortgages are an excellent way for seniors to access their home equity and improve their cash flow during retirement. However, there are many misunderstandings about how reverse mortgages work. Some believe there are loopholes or tricks in the system that allow for easy access to funds or ways to avoid repayment.

In this comprehensive guide, we will debunk common myths and misconceptions about reverse mortgages and explain what is and isn’t possible. Our goal is to clear up any confusion and help you make an informed decision about your options, free of misconceptions.

What Is a Reverse Mortgage?

A reverse mortgage allows homeowners aged 62 or older to convert a portion of their home equity into cash — without selling their home or making monthly mortgage payments.

The most common type of reverse mortgage is the Home Equity Conversion Mortgage (HECM), which is insured by the federal government.

However, there are also jumbo reverse mortgages available for high-value properties. Learn more about how reverse mortgages work.

Myth #1: ‘It’s Totally Free Money’

One of the most common myths about reverse mortgages is that seniors can live in their home for free without having to pay anything. This isn’t true. While reverse mortgages eliminate monthly payments, homeowners are still responsible for paying property taxes, homeowners insurance, and maintaining the home.

If you fail to meet these obligations, the lender can foreclose on the property. So, while a reverse mortgage can ease your financial burden, it doesn’t mean you can neglect these essential costs.

Myth #2: ‘The Bank Owns Your Home’

Another myth is that by taking out a reverse mortgage, you’re giving up ownership of your home. That’s not the case.

With a reverse mortgage, you remain the owner of your home. The lender holds a lien on the property, meaning they have the right to be repaid when you sell the home or move out. As long as you continue living in the home, you retain full ownership.

Myth #3: ‘You Could End Up Owing More Than Your Home Is Worth’

Many people worry that reverse mortgages could lead to owing more than the value of your home. However, HECM loans are insured by the FHA, which means you will never owe more than the value of your home when the loan becomes due.

This ‘non-recourse’ feature protects you from having to pay more than the home’s value, even if the loan balance exceeds the sale price.

Myth #4: ‘You Have to Pay Back the Loan Immediately’

Another common misunderstanding is that reverse mortgages require repayment right away. In fact, reverse mortgages only require repayment when the homeowner sells the home, moves out, or passes away.

Until one of these events occurs, you don’t have to repay the loan, and no payments are required. The loan balance grows over time, but the repayment is typically handled when the home is sold.

Are You Eligible for a Reverse Mortgage?

(Find out in 60 seconds)

The Truth About Reverse Mortgage Lines of Credit

A reverse mortgage lines of credit works similarly to a traditional home equity line of credit but with the key difference that you don’t need to make any monthly payments.

The amount of credit you have is based on your home’s equity, your age, and current reverse mortgage loan rates. You can draw from this line of credit as needed, and the credit grows over time, offering you increased access to funds as the value of your home or the interest rate changes. Explore how a reverse mortgage line of credit works.

Common Misunderstanding: ‘These Are Scams’

Some people believe that reverse mortgages have hidden loopholes or tricks that let banks dupe retirees out of their homes. The truth is that everything is governed by strict regulations and consumer protections, especially with HECMs.

What Is Not Possible With Reverse Mortgages?

It’s important to understand what reverse mortgages cannot do:

- They cannot cover all your living expenses unless you have significant equity in your home.

- They don’t allow you to receive a lump sum of money without repayment. The loan grows over time and must be repaid once the home is sold, moved out of, or the homeowner passes away.

- Reverse mortgages are not debt forgiveness; they are loans that must be repaid.

Should You Consider a Reverse Mortgage?

If you’re considering a reverse mortgage, it’s important to weigh both the pros and cons. A reverse mortgage line of credit can be a flexible, tax-free way to access the equity in your home, but it’s not for everyone. It’s especially helpful if you want financial flexibility in retirement or need a source of income but don’t want to sell your home.

However, it’s crucial to understand the terms of the loan, how much you’re borrowing, and the interest rates. A reverse mortgage line of credit is an option that requires careful planning, and it’s always a good idea to consult with a reverse mortgage specialist to see if it aligns with your goals.

Talk to a Reverse Mortgage Expert

At South River Mortgage, we specialize in reverse mortgages and can help you determine if a reverse mortgage is right for you. Our experienced team is here to guide you through the process, explain the terms, and help you understand reverse mortgage loan rates. We are committed to ensuring you make the best decision for your needs and goals.

📞 Call us now for a free consultation: (844) 230-6679