Written by Chris BirkVice President of Mortgage Insight Reviewed by Tierre Banks

Updated on Jan 01, 2025HECM Reverse Mortgage Interest Rates

| Interest Rates | Lending Limit | APR | |

|---|---|---|---|

| 5.88% (1.75 Margin) | $1,209,750 | 5.88% | Get Quote » |

| 6.13% (2.00 Margin) | $1,209,750 | 6.13% | Get Quote » |

| 6.38% (2.25 Margin) | $1,209,750 | 6.38% | Get Quote » |

| 6.63% (2.5 Margin) | $1,209,750 | 6.63% | Get Quote » |

HECM adjustable rates are rounded to the nearest 1/8th of a percent (0.125%). HECM adjustable rates update every Tuesday. (Updated 17 February 2026)

The next adjustment date is Tuesday, February 24, 2026. The projected index for next week is 4.13%, compared to this week’s index, which is 4.13%. This means that rates are projected to be between 5.88% and 6.63%.

Did you know?

South River Mortgage gets you the maximum cash out allowed by law on your HECM loan.

Calculate your numbers.

The fixed interest rates represent a 8.45% and 8.75% APR respectively. For adjustable interest rates, the APR is the same as the rate.

Jumbo Reverse Mortgage Interest Rates

| Jumbo Reverse Mortgage Rates | Lending Limit | |

|---|---|---|

| 9.39% | $4,000,000 | Get Quote » |

| 9.675% | $4,000,000 | Get Quote » |

Learn More About Jumbo Reverse Mortgages

Read our full length article on jumbo reverse mortgage lenders, where we do a deep dive on the jumbo programs currently available.

Reverse Mortgage Interest Rates – What You Should Know

How Interest Rates Affect Your HECM Loan Proceeds

Interest rates can have a substantial impact on the amount of loan proceeds that a HECM borrower may be able to access.

The principal limit factor (PLF) is multiplied by the lesser of the home value or the lending limit to determine the principal limit, which is the maximum amount of money that can be advanced on a HECM loan.

Sample Principal Limit Factors for a 62-Year Old Borrower Across Various Reverse Mortgage Interest Rates

Rate

PLF % (Percentage of Equity Available)

Or, if you prefer to see things graphically, you can see the relationship between HECM interest rates and principal limit factors.

Sample principal limit factors for a 62-year old borrower across various interest rates.

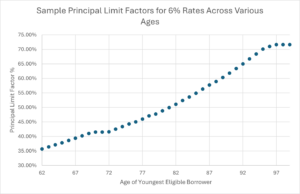

How Age Affects Your HECM Loan Proceeds

Higher ages provide additional proceeds on HECM loans, even at the same interest rates. Lower ages provide fewer proceeds on HECM loans.

The principal limit factor (PLF) is multiplied by the lesser of the home value or the lending limit to determine the principal limit, which is the maximum amount of money that can be advanced on a HECM loan.

Sample Principal Limit Factors for 6% Rates Across Various Ages

| Age | Rate | PLF % |

|---|---|---|

| 62 | 6% | 35.7% |

| 65 | 6% | 37.8% |

| 70 | 6% | 41.5% |

| 75 | 6% | 44.3% |

| 80 | 6% | 48.8% |

| 85 | 6% | 54.9% |

| 90 | 6% | 61.8% |

| 95 | 6% | 70.1% |

Selected ages and rates are provided from HUD 2017 PLF tables. This is just an illustration and may not accurately reflect today’s market rates. To calculate your numbers specifically, use a HECM Calculator.

What Determines My Interest Rate?

Frequently Asked Questions

What is the HECM rate lock?

HECM loans can have their expected rate locked for up to 120 days. This is valuable because it allows you to obtain the lowest interest rate available, at any point, during the application process.

South River Mortgage automatically sets up the expected rate lock and finds the lowest rate for you when calculating your principal limit.

What is the difference between the initial rate and the expected rate?

If you have an adjustable rate HECM:

- The initial rate is the rate that is used to calculate interest charges on your loan. The initial rate usually follows either the 1-Year CMT or the 1-Month CMT index.

- The expected rate is the rate that is used to determine the principal limit on your loan. The expected rate follows the 10-Year CMT index.

If you have a fixed rate HECM, then your initial rate and expected rate are the same.

What is the margin for an adjustable rate HECM loan?

The margin is the set number added to the index to determine your rate. The margin is a number that does not change, and it is generally between 1.5% and 3%.

Note that there is no margin for a fixed rate HECM.

What is an index for an adjustable rate HECM loan?

The index represents the market interest rates at the time. When your loan interest rate adjusts, it will adjust to the market interest rates (as long as they are below the caps on the loan).

For the initial rate, the 1-year Constant Maturity Treasury (CMT) or the 1-month Constant Maturity Treasury (CMT) index is used. For the expected rate, the 10-year Constant Maturity Treasury (CMT) is used.

Note that there is no index for a fixed rate HECM loan.

Why are most HECM loans adjustable rates?

Most HECM loans are adjustable rates because these are the only program that allows for the payment plan flexibility.

HECM fixed rates require all the cash to be taken at once, and in some cases, cash may be unavailable.

The HECM adjustable rate represents a better option for most people, as it allows them to draw cash as they need (allowing them to pay interest on only the cash they truly need).

What are the rate caps on the adjustable rate HECM?

The rate caps may vary, but they are usually 1% periodic (i.e. monthly or annual) cap and a 5% lifetime cap.

If you have an existing loan, check your HUD-1 settlement statement to verify the rate cap structure on your loan.

How frequently do the rates adjust on the adjustable rate HECM?

The most common adjustment frequency for adjustable rate HECMs is either monthly or annually. If you are not sure, you can check on your HUD-1 settlement statement to verify the adjustment frequency of your loan.

Calculate Your Eligibility

Your age determines the principal limit factor (PLF) for your reverse mortgage. Older homeowners typically qualify for higher loan amounts because the loan term is expected to be shorter.

Your home's current market value is used to calculate how much you may borrow. The higher your home value, the more you may be eligible to receive (up to FHA lending limits).

Any existing mortgage must be paid off with your reverse mortgage proceeds. We need this to calculate your net available funds after paying off your current loan.