What Is a Reverse Mortgage? A Guide for Homeowners 62+

By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

If you’re like many homeowners in or near retirement, your house isn’t just where you live–it’s one of your biggest financial assets. But tapping into that equity without selling or moving? Sounds complicated, right?

That’s where a reverse mortgage comes in.

At South River Mortgage, we talk to people every day who’ve heard of reverse mortgages but aren’t quite sure how they work, or whether they’re safe, smart, or even meant for someone like them.

This simple guide breaks it all down:

- What a reverse mortgage is

- How it works

- Who it’s for

- The pros, cons, and common myths

Let’s walk through it together, in plain English.

Why Work With South River Mortgage?

We know this is a big decision. That’s why we’re here to help you understand all your options—no pressure, no confusion.

At South River Mortgage, we specialize in reverse mortgages. This isn’t just one of many loan types we offer—it’s our focus. You’ll get one-on-one support from experienced advisors who know this process inside and out. We believe in education first, making sure you feel confident and informed every step of the way.

We offer both federally insured and private reverse mortgage options, depending on what best fits your needs. Whether you’re just starting to explore or ready to take the next step, we’re here to help.

What Is a Reverse Mortgage?

A reverse mortgage is a special kind of loan for homeowners aged 62 and older. It lets you borrow money using the equity in your home, but here’s the key difference: you don’t have to make monthly loan payments like with a traditional mortgage.

Instead, the lender pays you.

You stay in your home. You stay on the title. The money you receive is usually tax-free. And you won’t have to repay the loan until you move out, sell the house, or pass away.

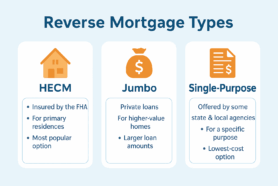

The most common type is a Home Equity Conversion Mortgage (HECM), which is federally insured by the U.S. Department of Housing and Urban Development (HUD). There are also private “jumbo” reverse mortgages available for higher-value properties.

Who Qualifies for a Reverse Mortgage?

Most of the folks we work with are surprised at how accessible these loans can be. To qualify, you’ll need to:

- Be 62 or older

- Own your home (or have a small remaining mortgage balance)

- Live in the home as your main residence

- Ensure the property meets eligibility standards

- Undergo a financial assessment

You’ll also be required to attend a HUD-approved counseling session to ensure you fully understand the loan.

You can qualify even if you’re retired, living on Social Security, or not working at all.

What Are the Benefits?

Reverse mortgages carry tons of benefits for retirees, like:

- No monthly mortgage payments. This is a big one. You don’t have to worry about sending in a check every month.

- Tax-free cash. The funds you receive aren’t taxed, which can be a nice way to stretch your budget.

- Stay in your home. You don’t have to move. In fact, this loan is designed to help you stay put longer.

- Flexibility. Take a lump sum for a big project, get monthly income to supplement retirement, or open a line of credit for emergencies.

- Peace of mind. You know you have access to funds, without needing to sell your home.

And What Should You Watch Out For?

While reverse mortgages bring a lot to the table, they aren’t for everyone. Here’s what to watch out for before you decide:

- Your loan balance grows over time. Since you’re not making payments, the interest adds up and reduces your equity.

- There may be less to leave behind. If you planned to pass your home on to heirs, there might be less value left in the property.

- You must keep up with home expenses. That means paying property taxes, homeowners’ insurance, and keeping the home in good shape.

- It’s not ideal if you’re planning to move soon. If you think you’ll relocate in a few years, a reverse mortgage might not be the best fit.

What Can You Use the Money For?

We’ve seen clients use their reverse mortgage funds for:

- Monthly bills

- Paying off credit cards or other debt

- Medical expenses or in-home care

- Home improvements to make aging in place easier

- Travel or making long-postponed dreams happen

- Keeping a line of credit on hand “just in case”

It’s your money, you choose how to use it.

Let’s Clear Up a Few Myths

There are a lot of misconceptions surrounding reverse mortgages, but here are the facts…

“I’m giving up ownership of my home.”

False. You still own your home and can live there as long as you want.

“The bank will kick me out.”

Also false. As long as you meet the basic requirements (taxes, insurance, upkeep), you’re protected.

“My kids won’t inherit anything.”

Your heirs still have options, like paying off the loan and keeping the house, or selling it and keeping any leftover equity.

“Only people in financial trouble get these.”

Not true. Many financially stable homeowners choose reverse mortgages as part of smart retirement planning.

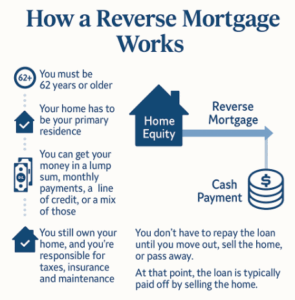

How Does It Work?

It’s actually pretty straightforward.

If your home is paid off, or mostly paid off, you’ve built up equity. That’s value you can’t spend unless you sell or refinance. With a reverse mortgage, you turn that equity into usable cash.

Here’s what happens:

- You must be 62 years or older

- Your home has to be your primary residence

- You can get your money in a lump sum, monthly payments, a line of credit, or a mix of those

- You still own your home, and you’re responsible for taxes, insurance, and maintenance

You don’t have to repay the loan until you move out, sell the home, or pass away. At that point, the loan is typically paid off by selling the home.

Is a Reverse Mortgage a Good Fit for You?

A reverse mortgage might make sense if:

- You want to stay in your home for the long run

- You have substantial equity

- You need extra income or want a financial safety net

- You prefer not to take on monthly payments

- You want to delay tapping into other retirement accounts

It’s not a one-size-fits-all solution. But it can be a helpful piece of the puzzle for many older homeowners.

If you’re looking to downsize, relocate closer to family, or move into a more age-friendly home, a Reverse Mortgage for Purchase could help you do it—without taking on a monthly mortgage payment.

Conclusion

A reverse mortgage isn’t just about getting “access to cash.” It’s about giving yourself options.

For many retired homeowners, that means peace of mind, flexibility, and the ability to stay comfortably at home.

Of course, it’s not a one-size-fits-all decision. That’s why we’re here.

At South River Mortgage, we specialize in helping homeowners understand all their options. No pressure. Just clear answers, from experienced advisors who’ve helped thousands of people like you.

Want to see how much you could qualify for, or just ask a few questions?

Contact South River Mortgage today and let’s talk about what’s possible.

📞 Call us now: (844) 230-6679