Washington Reverse Mortgage Lenders

Trusted Washington reverse mortgage lender. Unlock retirement cash with an FHA-insured HECM—no payments, no stress. A+ BBB rating.

Reverse Mortgage Product Options in Washington

| HomeForLife | HECM | |

| Traditional Reverse Mortgage (Reverse Mortgage 101) | Yes | Yes |

| Refinance Existing Reverse Mortgage with Another (HECM to HECM) | Yes | Yes |

| Purchase a Home with a Reverse Mortgage (HECM for Purchase) | Yes | Yes |

| Minimum Age for Eligibility in WA | Not Available | 62 |

| Get Your Quote → | Get Your Quote → |

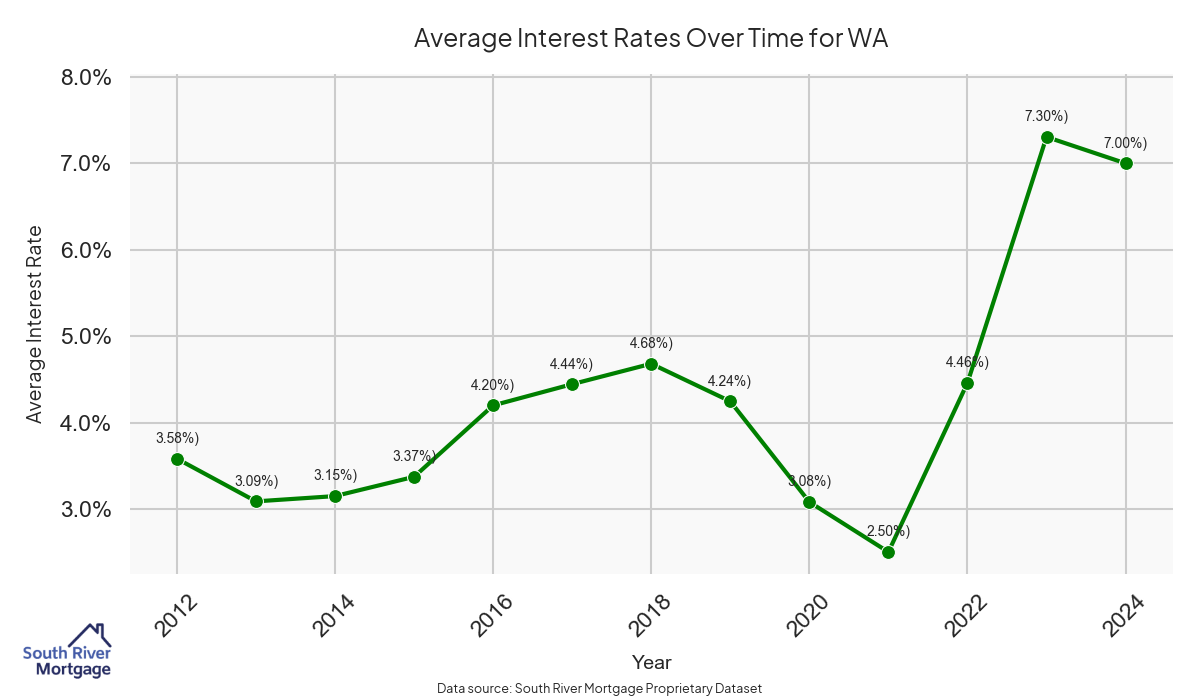

Reverse Mortgage Interest Rates in Washington

As of today, the 10-year CMT index is trading at 4.13%. Reverse mortgage interest rates adjust weekly on Tuesdays, so the next adjustment date will be Tuesday, March 17, 2026. (Updated 10 March 2026)

The projected index for next week is 4.13%, compared to this week’s index, which is 4.13%. This means that rates are projected to be between 5.88% and 6.63%.

Click to learn more about Reverse Mortgage Interest Rates (& how they affect you) →

Local Reverse Mortgage Lenders in Washington

Although South River Mortgage originates loans all across the country, we do maintain a local presence in Washington. We have a resident agent location at 3400 Capitol Blvd SE, Suite 101, Tumwater, WA 98501. Get Your Quote →

HUD also maintains a list of local lenders. Get Your Quote →

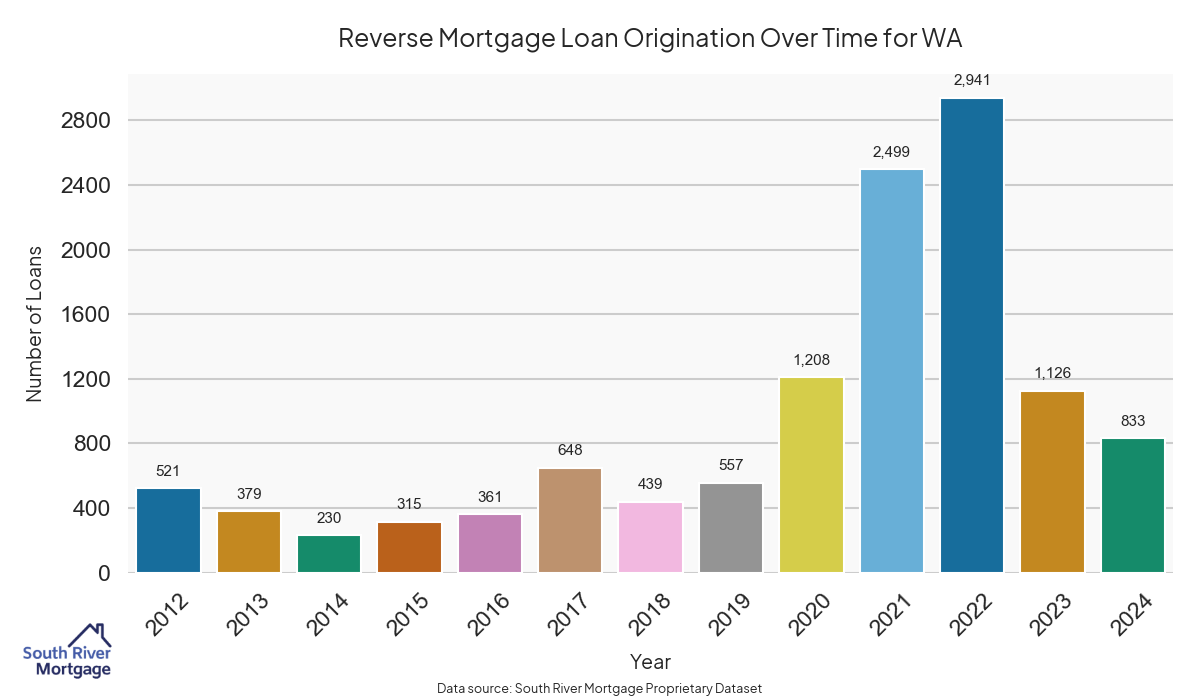

Reverse Mortgage Loan Origination Statistics in Washington

We have pulled together a number of useful reverse mortgage loan statistics for WA. These loan origination statistics are put together below as a courtesy, and as such, we cannot make any guarantees about the accuracy of the information.

Note that this data was sourced from a proprietary data set, so it includes loans outside of the FHA HECM loans listed on the HECM Portfolio Snapshot.

Reverse Mortgages in Washington

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

.

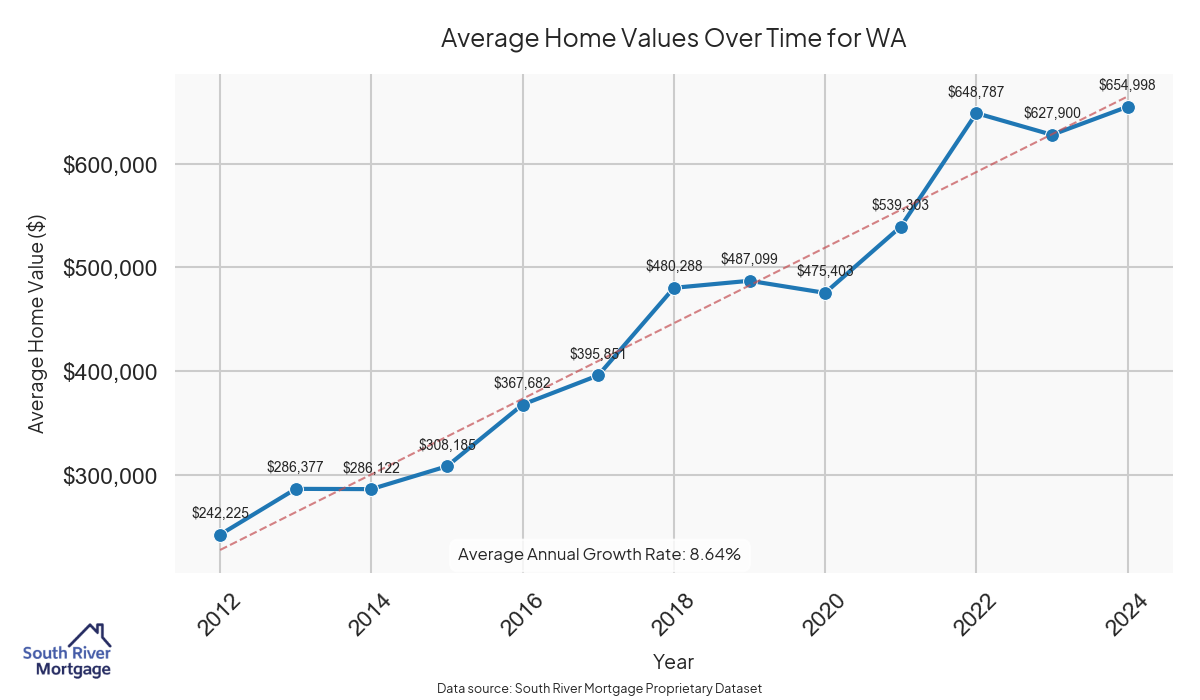

Average Reverse Mortgage Home Values in Washington

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

Reverse Mortgage Interest Rates in Washington

Download the dataset (anonymized) as a CSV file

Download the dataset (anonymized) as a CSV file

State Regulator & Licensing in Washington

Make sure you are working with a licensed mortgage lender in Washington. South River Mortgage maintains approval with Washington and holds the Consumer Loan Company License #CL-1854524.

County-Specific Loan Information in Washington

Washington has 33, and each county has its own specifics. We have compiled county-by-county loan statistics and information, whether you are looking for a reverse mortgage or just curious about loan origination activity. Kindly note that this information is provided on a best-efforts basis – and while we do as much quality control work as possible – we make no guarantees to the accuracy of loan statistical information provided

Choose any county to learn more about reverse mortgages in that area:

- Asotin County

- Benton County

- Chelan County

- Clallam County

- Clark County

- Columbia County

- Cowlitz County

- Douglas County

- Franklin County

- Grant County

- Grays Harbor County

- Island County

- Jefferson County

- King County

- Kitsap County

- Kittitas County

- Klickitat County

- Lewis County

- Mason County

- Okanogan County

- Pacific County

- Pierce County

- San Juan County

- Skagit County

- Skamania County

- Snohomish County

- Spokane County

- Stevens County

- Thurston County

- Wahkiakum County

- Walla Walla County

- Whatcom County

- Yakima County