Today, we’ll focus on something a little bit more analytical: why it makes sense now to actually join the mortgage industry. You’ll be glad you did.

Setting the Scene

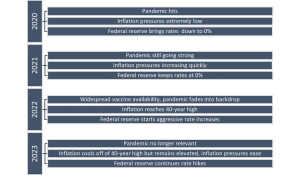

For those of you who are not following interest rates or financial markets, let’s take a moment to set the scene for the last few years.

2020

In 2020, the novel coronavirus pandemic hits the world by storm. Chaos ensues, and financial markets are extremely turbulent. On March 3, the Federal Reserve has an emergency meeting and immediately cuts rates by 0.50%, bringing their target rate to 1%[1]. This still does not provide enough cover – financial markets go haywire. The S&P 500 loses 30% of its value in a three-week span. The Federal Reserve does more: they cut the rates down to 0%.

Just around this time, the mortgage industry starts heating up. Interest rates at historically low levels unseen since the Great Financial Crisis of 2009. If you could get into the mortgage industry at this time, this was the time to do it: the average 30-yr mortgage rate was 2.96%.

2021

Throughout 2021, the Federal Reserve keeps interest rates at the same level. However, there is a little problem brewing. In January 2021, inflation is going at 1.4%[1] (Fed wants to see 2% inflation). By December 2021, inflation is up to 7%[2] — this is 3.5 times the target that the Fed has set. The party has to come to an end.

Now financial markets begin to worry about inflation, but the Fed says not to worry, and that it will go away on its own.

2022

With the pandemic losing relevancy and normal life returning, the Federal Reserve begins its crusade against inflation. They start out gently, raising rates by 0.25%.

Inflation proves powerful, so they increase again by raising rates by 0.50%. Still, taking too long, they bring out the largest rate hike seen in decades: 0.75%. They use this tool four times each in rapid succession.

Inflation improves a little bit, but the Federal reserve brings out a smaller 0.50% rate hike to end the year. With this rate hike being smaller than the prior ones, and being December, the analysts called it the Fed’s “Christmas gift”.

2023

In 2023, the Fed hikes another 5 times, but this time, they use their smallest tool, the 0.25% rate hike, used to “fine tune” the economy. In the beginning of 2023, inflation is at 6.4%. As of the latest read, inflation is at 3.2%, half of what it was at the start of this year: the genie is back in the bottle, and inflation has been reigned in.

Sounds like everything’s great again, right? Well, we’re running into some issues with all of these rate hikes:

- Banking Instability – The economy is facing a surge in bank failures, a crisis reminiscent of 2009 and the Great Depression era. These failures are being driven by a combination of liquidity issues, increased risk exposure, and economic stress, posing significant threats to financial stability.

- Escalating Unemployment – The job market is struggling, with unemployment rates not only surpassing pre-pandemic figures but also exhibiting a worrying trend toward further escalation. This suggests structural employment issues and a potential slowdown in economic growth.

- Rising Consumer Debt – There’s a growing concern as more individuals fall behind on their financial obligations, with credit card delinquencies climbing beyond pre-pandemic levels. This rise indicates a strain on household finances, potentially leading to a broader impact on consumer spending and economic health.

- Stagnant Real Estate Sector – The housing market has hit a standstill with a sharp downturn in both buying and selling activity. This freeze reflects rising interest rates, economic uncertainty, and affordability challenges, making it difficult for the market to gain momentum.

- Declining Automobile Market – The auto industry is experiencing a steep decline in sales, with car prices dropping rapidly due to decreased demand. This trend reflects a broader economic slowdown, where consumers are hesitant to engage in large purchases.

It’s starting to look like we are moving toward a global economic slowdown, or a recession.

Markets Are Already Seeing It

Financial markets are already seeing the economic slowdown, and they are starting to reduce interest rates as a result. The Federal Reserve is quick to follow the financial markets.

Analysts at large banks are already calling for major rate cuts in 2024 as the Federal Reserve declares victory over inflation and aims to avoid allowing the economy fall into recession.

Hey, haven’t we seen this cycle before? Doesn’t this look like 2020?

With all that being said, how does this effect you? Let’s look at the market implied timeline and the timeline of interviewing, getting licensed, and getting on the phones as a loan officer. It all lines up pretty nicely.

Next 3 Months

Interest rates: The market is already seeing the first rate cut coming in March 2024. Markets are forward looking, so the market is already starting to move interest rates down in the beginning of the year.

As a Loan Officer: From the first interview to passing the SAFE Exam and earning your first state licenses takes about 60 days in total. Seeing that we are now in November, being able to originate starting in mid-January fits the timeline perfectly for being able to take advantage of the tailwinds that the lower rate environment will provide.

4-6 Months Out

Interest rates: Financial markets are already seeing more rate cuts coming in 2024, and as new data continues to come in softer, the speed of the rate cuts only increases.

As a Loan Officer: After becoming licensed, honing your craft is one of the next major items. This is usually achieved in the first 6 months as loan officers learn more about the product and overall landscape.

Start Your Licensing Journey with South River Mortgage

At South River Mortgage, we offer an award-winning training program tailored to empower both recent graduates and all aspiring professionals. Our intensive three-week bootcamp is meticulously designed to equip you with the knowledge and skills needed to successfully pass the mortgage SAFE exam.

Within approximately one month, you’ll transition from training to actively engaging with clients, ready to originate loans with confidence and expertise.

Differential Rate Sensitivity: Reverse vs. Forward Mortgages

The reverse mortgage sector is often recognized for being less sensitive to interest rate fluctuations compared to the forward mortgage market.

In scenarios where rates decline, this characteristic serves as a significant advantage for institutions like South River Mortgage. While the forward mortgage market requires substantial rate decreases to stimulate refinancing activities, the impact of rates in the reverse market primarily affects the borrowing capacity.

Even with modest rate reductions, such as a 0.50% cut, we can approve more applicants in the reverse market and offer them larger loans. This dynamic allows for a broader qualification criteria and enhances the lending potential in the reverse market, even during minor rate adjustments.

Putting it all together, as interest rates have peaked and begin decrease, now is a perfect time for loan officers to become licensed, build skills, and get ready for the next wave. It is upon us, and no one would want to miss it.

[1] (lower bounds)

[1] https://www.bls.gov/news.release/archives/cpi_02102021.pdf

[2] https://www.bls.gov/news.release/archives/cpi_01122022.pdf