Overview

With many reverse mortgage options on the market, it can be difficult to understand which program is right for you. In this article, we will compare two popular reverse mortgage programs, the HECM and HomeForLife, to help you better understand your options.

What types of reverse mortgages are there?

A key differentiator between reverse mortgage programs is whether the loan is insured by the government or a private lender. The Home Equity Conversion Mortgage is a reverse mortgage program that is insured by the Federal Housing Administration (FHA). This program is often referred to as “HECM” (pronounced “HECK-UM”). This is the only reverse mortgage insured by the government, but it is one of the most common types of reverse mortgage programs on the market.

Another popular reverse mortgage product on the market is the HomeForLife reverse mortgage. This program was created by a private lender, called South River Mortgage. This program is similar to the HECM, but it has different eligibility requirements and product features.

It is encouraged that you review the terms and conditions of each program before committing to one. If you are interested in discussing your options over the phone, South River Mortgage offers a free reverse mortgage financial assessment at (844) 230-6679.

Compare Two Programs: HECM and HomeForLife

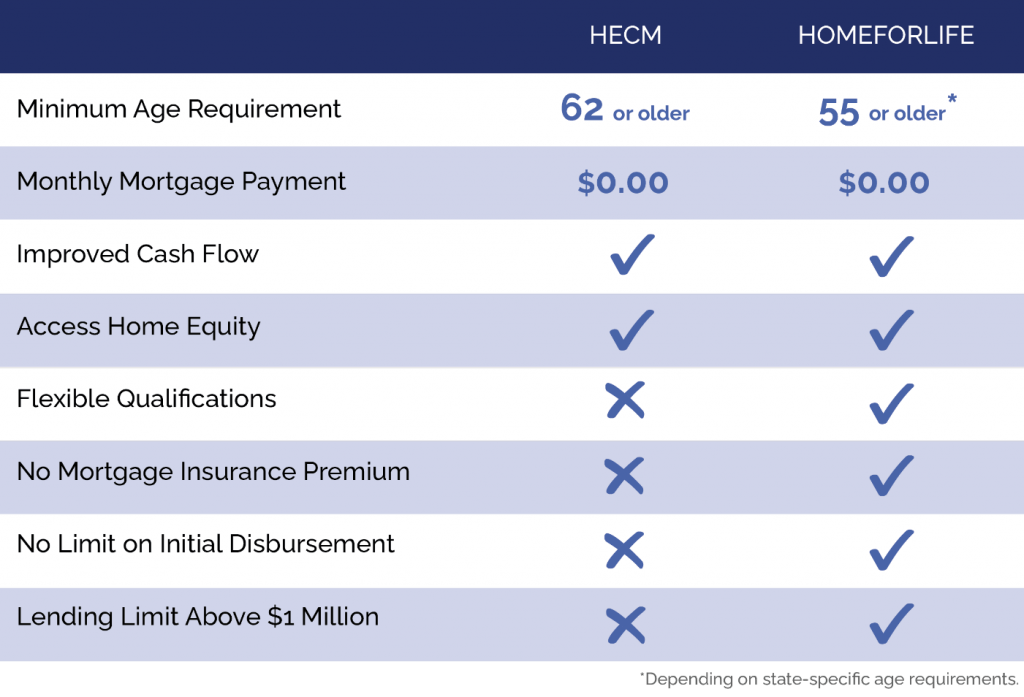

The HomeForLife reverse mortgage shares many similar features to the popular Home Equity Conversion Mortgage (HECM). However, there are several important differences that set these two programs apart.

Want more program details? Download a FREE Reverse Mortgage Toolkit.

With any mortgage, the borrower must continue to make property charge payments, such as taxes, insurance, and maintenance, as well as comply with other loan terms.

Minimum Age Requirement

These two programs have different eligibility criteria. One example of the different eligibility requirements is age. For a HECM reverse mortgage, you must be at least 62 years old to apply. However, for a HomeForLife reverse mortgage, you must be at least 55 years old to apply depending on state-specific age requirements.

To see the HomeForLife age requirements for your state, visit the interactive map at the bottom of our page.

Monthly Mortgage Payment

Neither the HECM nor the HomeForLife program will require you to make your monthly mortgage payments. The required minimum monthly mortgage payment is $0.00 for both programs. If you would like to continue paying your monthly mortgage payment with a reverse mortgage, you still can. This is why many people refer to this payment as “optional” with a reverse mortgage. As with any mortgage, the borrower must continue to make property charge payments, such as taxes, insurance, maintenance, as well as comply with other loan terms.

Improved Cash Flow

With limited income in retirement, many people encounter a cash flow issue. Increasing cash flow can positively impact your retirement by enabling you to pay for in-home care, home upgrades or other important expenses. Both of these programs can help improve cash flow.

Access Home Equity

Both programs, as well as all reverse mortgages, allow homeowners to tap into their home equity without selling or moving out of their home.

Are you interested in learning how much you can qualify for? Get Started.

Flexible Qualifications

To qualify for a reverse mortgage, each program will take several factors into consideration. These factors may include your credit history, the value of your home, and more. HomeForLife product experts suggest that HomeForLife may offer more flexible qualifications than a standard HECM due to the abbreviated financial assessment and less frequent 2nd appraisals.

No Mortgage Insurance Premium

The mortgage insurance premium is a fee that applies to HECMs. You will be charged an initial mortgage insurance premium at closing. Then, you will be charged an annual mortgage insurance premium over the course of the loan. An important distinction to make between these programs is that HomeForLife does not collect a mortgage insurance premium, although other costs may apply.

No Limit on Initial Disbursement

The HECM program offers several payment options: monthly installments, lump sum, line of credit, or a combination. However, with a HECM, you may have to wait up to a year before you can collect the full amount of cash you are entitled to. The HomeForLife loan offers your payment in a lump sum with no disbursement limit, meaning you can collect 100% of the proceeds at closing.

Lending Limits

The term “lending limit” refers to the maximum amount of money you can borrow in your desired reverse mortgage program. The FHA sets lending limits each year that apply to the HECM program. Since HomeForLife is a product independent of the FHA, HomeForLife is able to offer a higher lending limit, which might mean more cash from your property.

Conclusion

Choosing a reverse mortgage program is a big decision that requires evaluating several options. Depending on your circumstance, you may find that one program better serves your interests than another program. Select the program that best helps you meet your financial goals during retirement.

For guidance on which program to apply for, you may wish to take advantage of South River Mortgage’s free reverse mortgage financial assessment by calling (844) 230-6679.

Read more Frequently Asked Questions about reverse mortgages.