Reverse Mortgage Counseling

By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

Have questions about HECM counseling certificates? We’ve got (tons) of answers.

How do I get a HECM reverse mortgage counseling certificate?

There are a few steps to obtaining a HECM reverse mortgage counseling certificate:

- Obtain your pre-counseling set of documents. This includes your loan comparison page, your amortization schedule, and your total annual loan cost (TALC). These documents will be personalized for you and your specific situation. You will also be provided with “Preparing for Your Counseling Session” and “Use Your Home to Stay at Home”.

- Schedule an appointment with a HUD-approved counseling agency. For your convenience, we have a list of national HUD-approved counselors listed below:

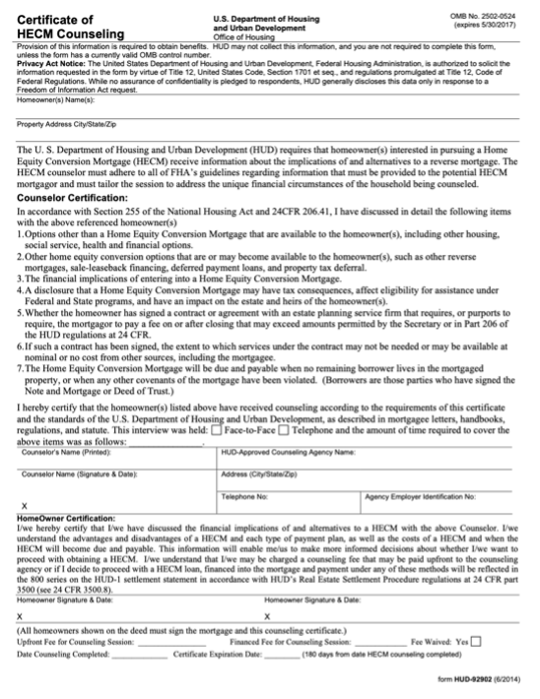

- Attend your counseling session as scheduled. Upon successful completion of your counseling session, you will be granted a HECM counseling certificate. The document looks like this:

Figure 1 – Sample HECM Counseling Certificate (HUD-92902)

What do we talk about in a counseling session?

The beauty of the counseling session is that it is personalized to the client’s specific situation. No two counseling sessions are the same.

HUD provides a general roadmap to completing a HECM counseling session:

- Understand Why the Client is Interested in a Reverse Mortgage

The counselor will start by asking questions to understand your situation and why you’re looking into a HECM loan. Are you trying to cover living expenses, pay for medical bills, or just want more financial security? It’s all about figuring out your specific concerns and goals. - Talk About Your Needs and Unique Situation

This part is all about you-your finances, your home, and what you hope to achieve. The counselor will ask about your income, expenses, debts, and whether this loan fits your big-picture financial plans. - Check If You (and Your Home) Qualify

The counselor will go over the eligibility rules for you and your home. For example:

- Are you old enough to qualify (usually 62+)?

- Is the home your primary residence?

- Is the property in good shape

How long does the counseling session take?

HUD suggests that counselors should spend at least 60 minutes to conduct the counseling session. This is because the HECM program has a lot more details than a traditional mortgage loan.

Some counseling sessions may last less than 60 minutes, but when this happens, the counselor must explain why the session did not last at least 60 minutes.

What do we talk about in a counseling session?

Throughout the counseling session, the counselor will review important details of the HECM loan with the client. While this is not an exam, HUD has published sample review questions that counselors must review with clients to make sure that they understand the program they are looking into.

The idea is that the counselor will explain an important feature of the loan, and the client must be able to answer a related question to make sure that they understand.

Counselors are allowed to ask additional questions from the list if they feel that it would be helpful for the client. Clients must be able to answer 5 out of the 10 questions correctly for the counselor to be able to issue a HECM Counseling Certificate.

The Counselor’s 10 Questions (& Answers!)

The reverse mortgage counselor is required to ask 10 questions from the list below.

As a benefit to the reader, we have answered the counseling questions below. If you have follow-up questions regarding the answers below, you may wish to spend more time discussing any specific topic during your counseling session.

General questions about HECMs and other reverse mortgage products:

- When you have a HECM, who owns your house (whose name is on the title/deed)? When does the loan have to be repaid?

When you have a HECM, you own your home and remain on the title and deed.The loan has to be repaid when you are no longer living in the home, or if you do not keep up with your requirements as part of the HECM loan. - There are several options for receiving your HECM proceeds. Of those, which option are you interested in and how does it work. What happens if you change your mind later and want to change your payment plan?

There are many different ways you can receive HECM proceeds, which includes lump sum, line of credit, monthly payment for a set period (term payment), and a monthly payment for life (tenure).You can elect to change your payment plan by reaching out to your loan servicer. They may charge a nominal fee for this, up to $20. - When you have a HECM, can the lender require you to make monthly payments?

No, there are no monthly payments required with the HECM loan. - When does the HECM have to be paid back?

The HECM loan must be repaid when you are no longer living in the home, or if you do not keep up with your requirements as part of the loan.

Questions about the financial implications of a HECM or other reverse mortgage products

- What responsibilities as a homeowner you have to continue after you get a HECM? What may happen if you do not keep up these responsibilities?

As a homeowner, you must continue to:

1) Occupy your property as your primary residence

2) Keep your home in good repair

3) Pay your property charges (items like property taxes, homeowner’s insurance, flood insurance, and HOA/condo dues).If you fail to keep up with these responsibilities, your loan will go into default, and it can be called due. Eventually, if you fail to keep up with your responsibilities, you may even face foreclosure. - A HECM may require either a partial or full Life Expectancy Set-Aside (LESA) at the closing which is designed to cover hazard insurance, property taxes, and other property assessments. Where will the funds come from to establish the LESA and how will that impact overall HECM proceeds available? If you have a LESA and all the funds have been exhausted over time, who is responsible for the continued payment of the property charges?

Funds from the LESA come from funds that would be available to you as cash out.If the funds from the LESA have been depleted, then you as the homeowner are still responsible for continuing to pay your property charges. - What happens if you use up all the money that is available from the HECM? (Utilize examples tailored to client’s circumstances, e.g., “What if you no longer had any remaining HECM proceeds to access?” or “Can you share how you would pay the property charges, maintenance, and repairs necessary to make your house safe and livable?”)

If you use up all the money that is available in your HECM, you may not have other financial resources. You may need to rely on your personal savings, income, or family to keep up with property charges, maintenance, and repairs to keep the home safe and livable. - If you were to relocate to another house, what are your responsibilities on the HECM loan? When your house is sold and the HECM is paid off, will the net proceeds give you the ability to pay for your move.

If you were to relocate to another house, you would no longer be meeting the responsibilities of your HECM loan, because one of the requirements is to occupy the property as your primary residence. This can cause the loan to go to default and become due.When your house is sold, the HECM will be paid off. There may be some proceeds remaining. Use our home sale calculator to see how much money will be left after the HECM is paid off. Depending on the situation, there may or may not be enough proceeds to give the ability to pay for your move.

Questions to use for clients with a potential or known Non-Borrowing Spouse (NBS)

- If your spouse is the Non-Borrowing Spouse on the HECM and deed, how will this affect their ability to stay in the house should the borrower leave for any reason?

If your spouse is a Non-Borrowing Spouse on the HECM and deed, then they will be able to stay in the house if the borrower should leave for any reason. However, they will not be able to receive any funds from the loan (i.e. no monthly payments or line of credit draws can be made to them). - Will the Non-Borrowing Spouse be allowed to use LESA funds to continue to pay property charges when the borrower dies?

No, the Non-Borrowing Spouse will not be able to use LESA funds to continue to pay property charges when the borrower dies. - If the borrower dies or is permanently placed in a healthcare facility, are there circumstances where the Non-Borrowing Spouse obtains the remaining loan funds, loan proceeds, or remaining principal limit? (Note that the HECM loan balance differs from net proceeds from the sale of the property).

The Non-Borrowing Spouse is not able to obtain funds from the loan. The Non-Borrowing Spouse would need to obtain their own HECM by refinancing, if eligible. - What terms of the mortgage are surviving Non-Borrowing Spouse responsible for maintaining upon the passing of the mortgagor?

The surviving Non-Borrowing Spouse must keep up with all of the original terms of the mortgage, which includes occupying the property, keeping the property in good repair, and paying property charges.

Questions for Refinances

- If you refinance your current HECM, will you still have to pay the FHA mortgage insurance? What is your understanding of how this insurance will be calculated?

Yes, FHA mortgage insurance (also known as mortgage insurance premium or MIP) is still due. The insurance is calculated the amount owed. The FHA HECM MIP rate is currently 0.5%. - What are some of the additional costs you will incur should you decide to refinance?

A HECM refinance can involve additional closing costs. These may include, but are not limited to, loan origination fees, initial mortgage insurance premium, title fees, state/county recording fees, appraisal fees, and others.Before refinancing, you should verify that the benefits outweigh the costs. Try our HECM refinance calculator to see if refinancing makes sense for your situation.

Questions for HECMs for Purchase

- When you purchase a home with a HECM, will the HECM be on your existing home or your newly purchased home?

The HECM would be on the newly purchased home. - How are closing costs determined for a HECM for purchase? What sources of funds (money) are allowed when you purchase a home with a HECM and pay closing costs?

When you purchase a home with a HECM, the closing costs are paid by the buyer. Some closing costs may be paid by the seller, up to 6%.The source of funds for purchase HECMs can be gift funds, funds from sale of previous home, or funds in the bank. “Mattress money” is not allowed. - Why is it important to get a home inspection?

The home inspection can help reveal functional issues that exist with the home. The appraisal is not the same as the home inspection, as the appraisal may only address show issues that are readily apparent. A home inspection focuses specifically on the home and its features, to ensure that everything is working. - What are some questions that you would want to ask a real estate professional about a property (assessments, HOA) purchased with a HECM?

You might want to ask about property taxes, homeowner’s insurance, if there is a homeowner’s association, if there are condo fees, or if the property is in a planned unit development (PUD).

What if I get the counseling questions wrong?

The counseling session is not an exam, so it is okay to get a few questions wrong. At least 5 of the 10 counseling questions must be answered correctly in order for the counselor to issue the counseling certificate.

If 5 of the 10 questions cannot be answered correctly, then the counselor will try to make additional accommodations to help the client better understand. HUD suggests that counselors do the following:

- Schedule a follow-up session to allow more time to go over the most important topics. They suggest doing the follow-up session at another time of day

- Help the client schedule a face-to-face session (either with the original counselor or a different counselor)

- Ask if the client could bring someone else to join another session

- Ask if there are other accommodations that might help the client during the session (e.g. difficulty hearing)

How long is a HECM counseling certificate valid for?

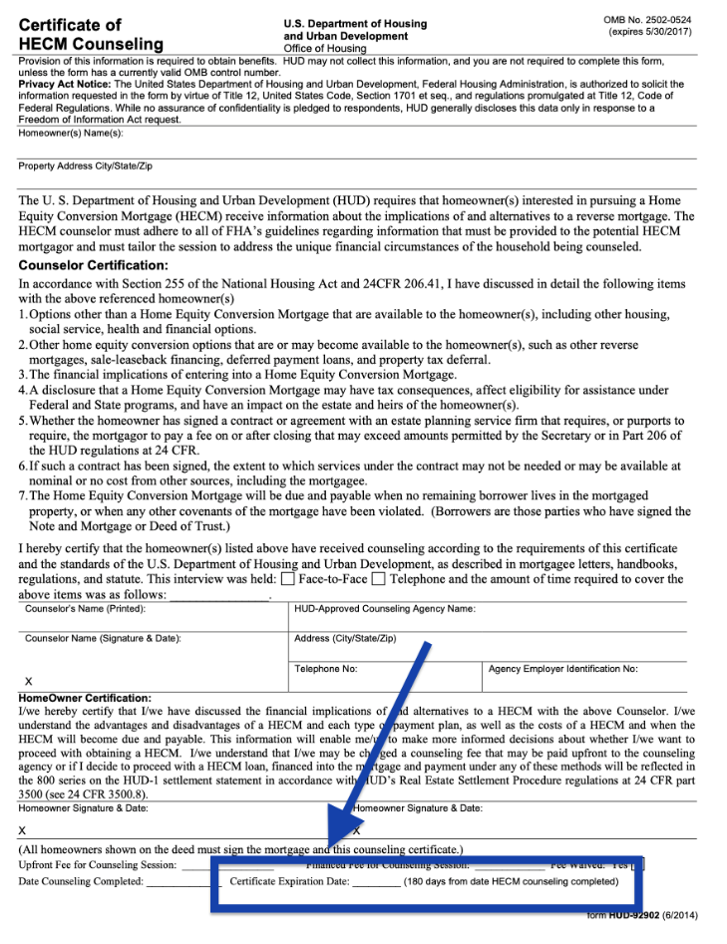

A HECM counseling certificate is valid for 180 days from the date of the session. The expiration date of the HECM counseling certificate will be listed on the bottom of the counseling certificate:

Figure 2 – Where to find your HECM counseling certificate expiration date

In some cases, an expired counseling certificate may be used to continue processing an FHA case number, but state-level requirements may apply.

If you already have a counseling certificate, you should check with your lender to see if the existing certificate can be used. In some cases, it may be able to be used, but in other cases, it may not, and a new counseling session may be required.

Who has to complete HECM counseling?

The following people are required to attend HECM counseling (mandatory):

- All borrowers, including non-borrowing spouses and non-borrowing owners

- Current trust beneficiaries

- If the borrower is incompetent, the person who is responsible for making decisions on their behalf (e.g. power-of-attorney or court-appointed conservator or guardian)

- Durable power of attorney

- Conservator

The following people may benefit from HECM counseling (optional):

- People who have a future interest in the property (trustees or trust beneficiaries)

- Children of the homeowner

- Children of a prospective HECM borrower who do not qualify for the HECM but are being removed from the title before closing

- Anyone that the homeowner might want to attend counseling

- Family members

- Homeowner’s attorney

- Friends of the homeowner

Who has to sign the HECM counseling certificate?

All mandatory parties (listed above) who complete counseling must sign the certificate. This means that children or other family members who are not on title are not required to sign the counseling certificate.

Is my HECM counseling private and confidential?

Yes. One of the key requirements of HUD-approved counseling agencies is that they keep your information private and confidential. Your privacy and confidentiality in HUD-approved housing counseling is required by federal law.

Can a counselor suggest any specific lender?

No. Counseling agencies are required to provide unbiased and impartial advice based on a client’s circumstances. A counselor cannot speak for any specific lender or assume that a client wants to do business with any specific lender.

What is emergency reverse mortgage counseling?

Emergency counseling services may be available in specific cases. Emergency counseling occurs when the client receives a counseling session without scheduling in advance or receiving counseling documents in advance.

HUD allows counselors to provide emergency counseling services when:

- The client may soon be losing their home (and can provide documentation to support this). For example, if you are facing upcoming foreclosure action, you may be eligible for emergency counseling.

- The client requires medical treatment or emergency in home care (and the reverse mortgage would be the only way to provide the proceeds to do this). For example, if you need emergency in home care that would be paid for by a reverse mortgage, you may be eligible for emergency counseling.

Can I waive my reverse mortgage counseling?

If this is your first reverse mortgage, it is not allowed to waive reverse mortgage counseling.

If you already have a HECM loan, you might be eligible to waive your reverse mortgage counseling in some cases.

You must be able to meet all the requirements below in order to waive your reverse mortgage counseling:

- You are refinancing a HECM with another HECM loan (i.e. a HECM to HECM refinance)

- You live in a state that allows you to waive counseling. Counseling may not be waived in the following states:

- California

- Massachusetts

- Minnesota

- New York

- North Carolina

- Tennessee

- Texas

- Vermont

- You did not previously waive counseling on your last HECM loan

- Your last HECM loan was within the past 5 years

- You are receiving a 5:1 increase between the principal limit and closing cost ratio

References

- HUD HECM Counseling Protocol (Handbook 7610.1, issued 04/2024) – PDF Download for HUD Counseling Handbook 04-2024

- See Chapter 4, pgs. 41-55

- See Appendix 1: HECM Counseling Protocol, pgs. 86-184