By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

Have questions about HECM reverse mortgage counseling certificates?

Good. You’re supposed to.

Counseling is a required step for getting a reverse mortgage—but it’s not a test, it’s not a sales pitch, and it’s not designed to trip you up. It exists to make sure you understand how the loan works and that it truly fits your situation.

Let’s walk through exactly what happens, step by step.

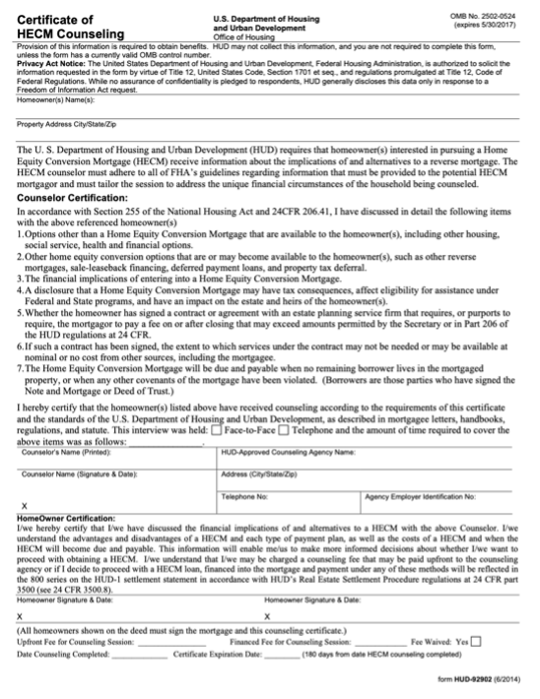

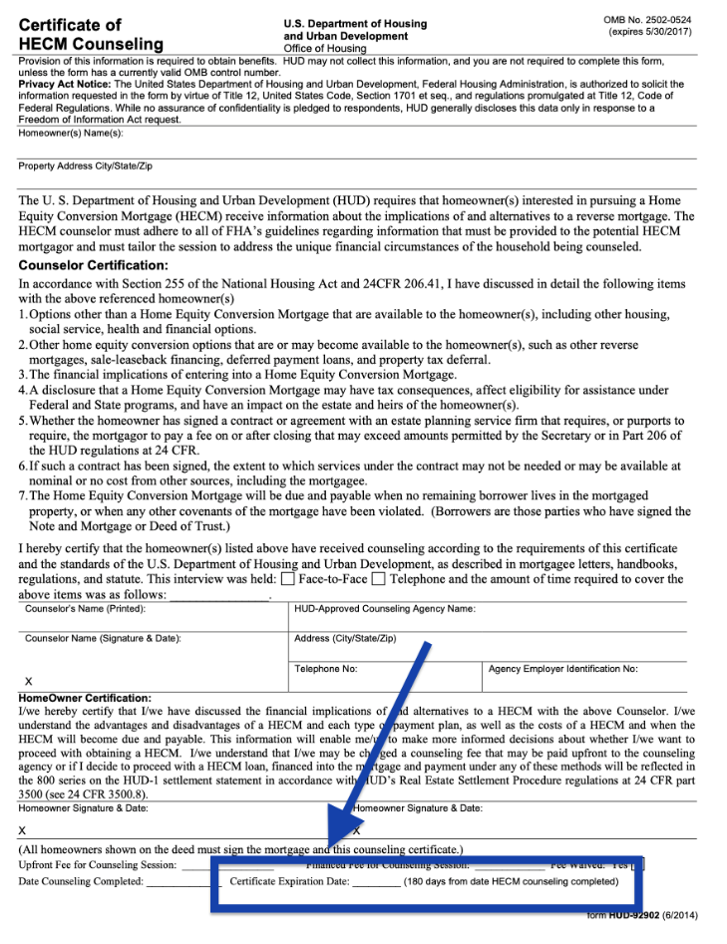

Figure 1 – Sample HECM Counseling Certificate (HUD-92902)

How Do I Get a HECM Counseling Certificate?

Getting your counseling certificate is simple. There are just a few steps.

Step 1: Review Your Pre-Counseling Documents

Before your counseling session, you’ll receive a personalized set of documents, including:

- A loan comparison page

- An amortization schedule

- A Total Annual Loan Cost (TALC) disclosure

- “Preparing for Your Counseling Session”

- “Use Your Home to Stay at Home”

These documents are customized to your situation and help you understand the loan before you ever speak with a counselor.

Step 2: Schedule Counseling With a HUD-Approved Agency

You’ll schedule your session with a HUD-approved counseling agency. These counselors are independent and do not work for any lender.

Step 3: Attend the Counseling Session

Once you complete the session, the counselor will issue your HECM Counseling Certificate. This certificate is required before your loan can move forward.

What Happens During the Counseling Session?

No two counseling sessions are exactly the same, because no two homeowners are the same.

That said, HUD provides a general structure counselors follow.

1. Why Are You Interested in a Reverse Mortgage?

The counselor will start by understanding your goals.

Are you looking to:

- Cover living expenses?

- Pay medical bills?

- Reduce financial stress?

- Create more security in retirement?

There’s no right or wrong answer. This part is about clarity.

2. Reviewing Your Financial Situation

Next, the counselor will talk through your income, expenses, debts, and overall financial picture. This is not judgmental—it’s about determining whether a reverse mortgage makes sense as part of your broader plan.

3. Confirming Basic Eligibility

The counselor will also review key eligibility items, such as:

- Are you at least 62 years old?

- Is this your primary residence?

- Is the property in acceptable condition?

This helps avoid surprises later in the process.

How Long Does Counseling Take?

HUD recommends counseling sessions last at least 60 minutes.

Reverse mortgages have more details than traditional loans, so counselors are expected to spend adequate time explaining them. Some sessions may be shorter, but if so, the counselor must explain why.

The Counselor’s Questions (This Is Not a Test)

During the session, the counselor will explain key features of the HECM loan and ask questions to make sure you understand.

This is not an exam.

HUD requires counselors to review 10 questions. You only need to answer 5 out of 10 correctly to receive your certificate.

The Counselor’s 10 Questions — Explained Simply

Who owns the home with a HECM?

You do. Your name stays on the deed and title.

The loan is repaid when you no longer live in the home or fail to meet loan requirements.

How can you receive HECM funds?

You can choose:

- A lump sum

- A line of credit

- Monthly payments for a set period

- Monthly payments for life

You can change your payment plan later by contacting your loan servicer. A small fee (up to $20) may apply.

Are monthly mortgage payments required?

No. HECMs do not require monthly mortgage payments.

What responsibilities do you keep as a homeowner?

You must continue to:

- Live in the home as your primary residence

- Maintain the property

- Pay property charges (taxes, insurance, HOA or condo fees)

If these responsibilities are not met, the loan can go into default.

What is a Life Expectancy Set-Aside (LESA)?

A LESA may be required to help cover property taxes and insurance. These funds come from your available loan proceeds.

If LESA funds are eventually used up, you are still responsible for paying property charges.

What happens if you use all available HECM funds?

If all loan funds are used, you’ll need to rely on other income, savings, or family support to continue paying property charges and maintaining the home.

What happens if you move?

If you move out, the loan becomes due.

After the home is sold, any remaining equity belongs to you or your estate.

What about a Non-Borrowing Spouse?

A non-borrowing spouse may remain in the home but:

- Cannot receive loan proceeds

- Cannot access LESA funds after the borrower passes

They must still meet all loan obligations.

What if I refinance a HECM?

Mortgage insurance still applies, and refinancing includes closing costs. It’s important to confirm the benefits outweigh the costs before proceeding.

What if I get questions wrong?

That’s okay. Counseling is not pass/fail.

If fewer than 5 questions are answered correctly, the counselor may:

- Schedule a follow-up session

- Suggest an in-person meeting

- Allow a trusted person to attend

- Offer accommodations if needed

How Long Is the Counseling Certificate Valid?

Your counseling certificate is valid for 180 days from the session date.

In some cases, an expired certificate may still be usable depending on state rules—but you should always confirm with your lender.

Who Must Attend Counseling?

Required:

- All borrowers

- Non-borrowing spouses or owners

- Trust beneficiaries

- Legal decision-makers (power of attorney, conservator, guardian)

Optional (but often helpful):

- Children

- Other family members

- Attorneys

- Trusted friends

Is Counseling Private and Confidential?

Yes. HUD-approved counseling agencies are required by federal law to keep your information private and confidential.

Are You Eligible for a Reverse Mortgage?

(Find out in 60 seconds)

Can a Counselor Recommend a Lender?

No. Counselors must remain neutral and cannot recommend or speak on behalf of any lender.

What Is Emergency Reverse Mortgage Counseling?

Emergency counseling may be available if:

- You are facing imminent foreclosure

- You need immediate funds for medical treatment or in-home care

Documentation is required.

Can I Waive Reverse Mortgage Counseling?

If this is your first reverse mortgage, counseling cannot be waived.

If you already have a HECM, you may qualify to waive counseling only if all requirements are met, including:

- You are refinancing a HECM into another HECM

- Your state allows counseling waivers

- You did not waive counseling previously

- Your last HECM was within 5 years

- The refinance provides sufficient financial benefit

Several states do not allow counseling waivers, including California, New York, Texas, and others.

Should I be worried about counseling?

Not at all. Counseling is meant to protect you, not block you. Most borrowers complete it without any issues.

I’m nervous about the questions—should I be?

That’s normal. The counselor explains everything first. You’re not expected to already know the answers.

Can you help me prepare before counseling?

Yes. We walk you through what to expect, review your documents, and help you feel confident before your session.

Another lender made this feel complicated—does it have to be?

No. With the right guidance, counseling is straightforward and stress-free.

What’s the smartest next step?

A quick, no-pressure review of your numbers. We’ll show you what you may qualify for before you invest time in counseling.

Ready to See What You May Qualify For?

You’ve learned how counseling works.

Now see what the numbers look like for you.

Call (844) 230-6679 or use our calculator to get a personalized estimate in seconds.