By Tyler Plack

Tyler Plack is the President of South River Mortgage. Tyler holds an active FHA Direct Endorsement (DE) underwriting certification and is the author of The Retirement Solution: Maximizing Your BenefitTyler is a seasoned entrepreneur and real estate investor renowned for his expertise in reverse mortgages and his commitment to addressing seniors' equity challenges. Tyler brings a unique perspective to his ventures, having built several successful companies throughout his career. His insights are frequently sought by industry publications, where he is recognized for his vast knowledge in the realm of reverse mortgages.

An avid investor in income-producing properties, Tyler is dedicated to helping seniors navigate their financial needs with compassion and expertise. When Tyler is not helping solve America's retirement crisis, he is a skilled pilot flying airplanes for fun.

A reverse mortgage can be an excellent tool to help seniors access their home equity and supplement their retirement income. However, understanding how much you can borrow and how the loan works is crucial before making a decision. One of the best tools available for this is the reverse mortgage calculator.

In this guide, we’ll walk you through the importance of using a reverse mortgage calculator in your financial planning, how to use it effectively, and how it can help you make informed decisions about your future.

We’ll also touch on factors like reverse mortgage loan rates, the reverse mortgage line of credit, and how these calculators give you a clearer understanding of your loan options.

Calculate Your Eligibility

Your age determines the principal limit factor (PLF) for your reverse mortgage. Older homeowners typically qualify for higher loan amounts because the loan term is expected to be shorter.

Your home's current market value is used to calculate how much you may borrow. The higher your home value, the more you may be eligible to receive (up to FHA lending limits).

Any existing mortgage must be paid off with your reverse mortgage proceeds. We need this to calculate your net available funds after paying off your current loan.

Why a Calculator Matters More Than You Think

A reverse mortgage calculator isn’t just about getting a number — it helps you see your options clearly.

Many homeowners are surprised at how much age, home value, or interest rates can change their available funds.

By trying out different scenarios, you can see what’s possible before ever talking to a lender.

Think of the calculator as your roadmap. It shows where you stand now and helps you plan what comes next.

What Is a Reverse Mortgage Calculator?

A reverse mortgage calculator is an online tool that allows homeowners to estimate how much money they could potentially borrow through a reverse mortgage. These calculators take into account several factors, including:

Your age (as reverse mortgages are available to homeowners 62 years or older)

- The value of your home (as the amount you can borrow depends on the home’s equity)

- The reverse mortgage loan rates

- The type of reverse mortgage (such as a Home Equity Conversion Mortgage (HECM), a jumbo reverse mortgage, or a reverse mortgage line of credit).

By entering these details into the reverse mortgage calculator, you can get an estimated figure for how much you could potentially receive in loan proceeds.

You can find a reverse mortgage calculator on our website here: South River Mortgage Reverse Mortgage Calculator.

How the Calculator Estimates Your Results

Reverse mortgage calculators use the same basic formula lenders follow to estimate how much you can borrow, known as your principal limit.

The amount depends on four main things:

- Your age: The older you are, the more you can usually borrow.

- Your home’s value: Based on the current market value, up to the FHA limit ($1,149,825 for 2025).

- Interest rates: Lower rates mean more money available.

- Your current mortgage balance: Any remaining loan must be paid off first.

The calculator result isn’t a final quote, but it’s a realistic preview of what you could qualify for.

Why Should You Use a Reverse Mortgage Calculator?

Before jumping into a reverse mortgage, it’s important to have a clear picture of what the loan will mean for your financial future. Reverse mortgage calculators help you assess the amount of money you can borrow and understand how it fits into your overall retirement plan.

Here are some reasons why using a reverse mortgage calculator is a smart move:

1. Estimate Your Loan Amount

One of the most important uses of a reverse mortgage calculator is that it gives you an estimate of how much you can borrow. The amount you qualify for will depend on several factors:

- Your age: The older you are, the more you can potentially borrow.

- The value of your home: The more equity you have, the higher the loan amount.

- Current reverse mortgage loan rates: These can influence how much you are able to borrow.

- The type of reverse mortgage you choose, such as a lump sum, monthly payments, or a line of credit.

Using a reverse mortgage calculator gives you a better idea of your options and helps you plan your finances

2. Help You Plan Your Financial Future

With the estimated loan amount in hand, you can better plan your finances. Knowing how much you can borrow will help you decide how to allocate the funds for the best use, whether that’s covering medical expenses, home repairs, or supplementing your income during retirement.

For example, if you have a specific financial goal, like covering healthcare expenses, you can adjust the calculator’s inputs to find out exactly how much money you would have available. This helps you see whether your reverse mortgage can help meet those needs.

3. Compare Different Loan Options

Another benefit of a reverse mortgage calculator is that it lets you compare different options. For example, you might want to explore:

- A lump sum: If you need a significant amount of money upfront.

- Monthly payments: If you need a steady source of income.

- Reverse mortgage line of credit: If you prefer flexibility and want to borrow as needed.

Each option has its own benefits and drawbacks. The reverse mortgage calculator can show you how each option affects your borrowing limit and how the funds can be accessed.

What the Calculator Can and Can’t Tell You

A reverse mortgage calculator is a great starting point, but it can’t show everything.

Here’s what it can tell you:

- A good estimate of how much you might borrow.

- How your age, home value, and rate affect the amount.

- The difference between a lump sum, monthly income, or line of credit.

Here’s what it can’t tell you:

- The exact closing costs or insurance fees.

- Real-time rate changes that shift daily.

- State or county limits that may apply to your property.

Use it to get a clear picture first — then confirm your numbers with a licensed specialist for the most accurate results.

How Does a Reverse Mortgage Work?

Reverse mortgages are designed to allow seniors to convert part of their home equity into cash without monthly payments. The loan is repaid when the homeowner moves out, sells the home, or passes away.

Here’s how a reverse mortgage typically works:

Homeowners can access the equity in their home through a reverse mortgage; unlike traditional mortgages, there are no monthly payments on the loan. The loan balance, including interest, grows over time & the loan is repaid when the homeowner sells the home, moves out, or passes away. At that time, the home is typically sold to pay off the loan balance.

Are You Eligible for a Reverse Mortgage?

(Find out in 60 seconds)

Factors to Consider When Using a Reverse Mortgage Calculator

While a reverse mortgage calculator can give you a good estimate of how much you can borrow, it’s important to understand the factors that influence the results:

1. Reverse Mortgage Loan Rates

The interest rate on a reverse mortgage significantly impacts how much you can borrow. Higher interest rates can reduce the amount you can borrow because the loan balance will increase more quickly over time.

Using the reverse mortgage calculator will allow you to plug in the current interest rates and see how different rates affect the loan amount. Be sure to ask your advisor about reverse mortgage loan rates before using the calculator.

2. The Reverse Mortgage Line of Credit

The reverse mortgage line of credit is one of the most flexible options. It allows homeowners to borrow as needed, rather than taking a lump sum or monthly payments. The amount of credit you have is based on your home’s equity, your age, and current reverse mortgage loan rates.

You can draw from this line of credit as needed, and the credit grows over time, offering you increased access to funds as the value of your home increases or the interest accrues.

By using the calculator, you can see how this flexible option compares to lump sums or monthly payments. You can also assess how much you could borrow today and how much you might be able to access in the future.

3. Your Home’s Value and Location

Your home’s value is one of the most important factors in determining how much you can borrow. The better the value of the home, the more equity you have to access. The location of the home also plays a role because it impacts the property value and the amount you can borrow. For example, a home in a high-demand area may be worth more than a similar home in a less popular area.

Common Mistakes When Using a Reverse Mortgage Calculator

These tools are easy to use, but a few small errors can throw off your results. Avoid these common mistakes:

- Using your tax-assessed value instead of market value. County tax records often show lower numbers.

- Leaving out your spouse’s age. The youngest borrower’s age determines eligibility.

- Forgetting your current mortgage balance. It must be paid off when the loan closes.

- Thinking proceeds are taxable. Reverse mortgage funds are tax-free and don’t affect Social Security or Medicare.

Check your inputs carefully so your estimate reflects your true situation.

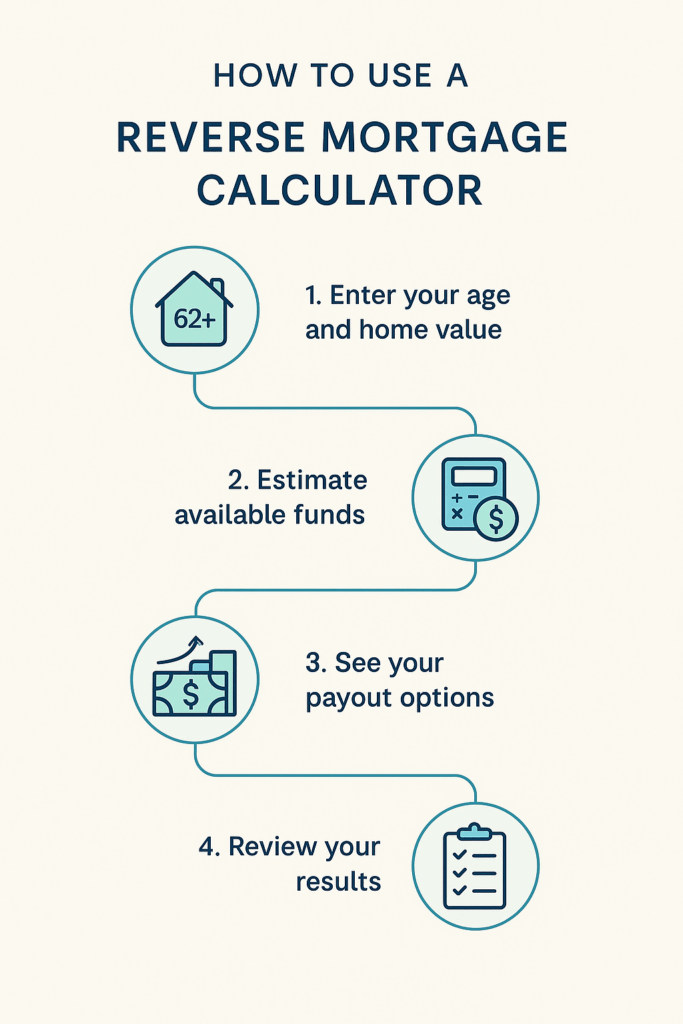

Steps to Using a Reverse Mortgage Calculator

1. Gather Your Information

Before using a reverse mortgage calculator, collect the following details:

- Your age and the age of your spouse (if applicable)

- Your home’s value

- Your loan balance, if applicable

- Current reverse mortgage loan rates

- Any other relevant financial details, such as outstanding debts

2. Visit the Calculator

Go to the reverse mortgage calculator on South River Mortgage’s website: Reverse Mortgage Calculator.

3. Input Your Details

Fill in the necessary information, including your home value, your age, and the type of reverse mortgage you want to explore.

4. Review the Results

The calculator will provide an estimate of how much money you can borrow, based on the data you entered. You can compare different options, such as a lump sum or line of credit, and see how the reverse mortgage line of credit grows over time.

5. Consult with a Reverse Mortgage Specialist

Once you have a rough idea of how much you can borrow; it’s a good idea to consult with a reverse mortgage specialist, like us in South River Mortgage. We can help you understand the nuances of the calculator results, such as interest rates and loan fees, and give you personalized advice on whether a reverse mortgage is right for you.

Example: Turning an Estimate into a Plan

Let’s say you’re 70 years old, your home is worth $400,000, and you don’t owe anything on it.

After entering your details, the calculator shows about $200,000 in available funds.

Here’s one way that could look:

- Use $150,000 to pay for home upgrades or debt payoff.

- Keep $50,000 as a line of credit that grows over time.

Now you’ve turned a simple number into a plan for a more comfortable retirement.

How to Read Between the Numbers

When you review your calculator results, focus on three things:

- Principal Limit: The total amount you may qualify for.

- Net Proceeds: The funds left after paying off any existing loans or fees.

- Line of Credit Growth: If you choose a credit line, any unused funds grow over time, giving you a larger safety net.

Knowing how these parts work together helps you understand what your quote really means.

Plan Your Retirement with Confidence

A reverse mortgage calculator gives you more than a number — it gives you peace of mind.

When you know what to expect, you can plan your retirement with confidence and make the best use of your home’s equity.

At South River Mortgage, our specialists can review your calculator results, explain your options, and show how different loan choices fit your goals.

Call (844) 230-6679 or use our free online reverse mortgage calculator to see your potential cash-out amount in minutes.

No commitment required — just clear answers to help you plan a stronger retirement.

FAQ: Using a Reverse Mortgage Calculator

Is the calculator result the same as a lender quote?

Not exactly. It’s an estimate based on averages. Your actual quote will depend on your home’s appraised value and the rate when you apply.

Do I need to include my spouse’s information?

Yes. The youngest borrower’s age determines how much you can borrow.

Why do results vary between websites?

Different sites use different rate assumptions. Ours follows current FHA rules for accuracy.

Does checking my eligibility affect my credit score?

No. Using a calculator doesn’t require a credit check.

Can I try different scenarios?

Yes. Changing your age, home value, or rate will show how those factors affect your available funds.